What happens if you default on bootcamp loan? Picture this: Six months after finishing a coding bootcamp, you’re chasing a tech job to repay a $15,000 loan. The job market’s tough, freelance gigs are scarce, and loan payments pile up like storm clouds. Missing a payment starts a risky spiral—delinquency, collections, and worse. In this guide, we’ll unpack the consequences of a default on bootcamp loan, from credit score damage to legal risks, and share real stories and solutions to help you avoid or recover from this financial pitfall. What happens if you default on bootcamp loans ?

This isn’t just a hypothetical. Thousands of bootcamp graduates face this reality yearly, caught between ambition and financial strain. In this article, we’ll unravel the consequences of defaulting on bootcamp loan, from credit score devastation to legal risks. More importantly, we’ll share actionable solutions, real-life stories, and historical lessons to help you navigate or avoid this crisis. Whether you’re a bootcamp alum, a prospective student, or just curious, this guide offers clarity and hope. Let’s dive in.

Understanding Bootcamp Loans: The Foundation of Your Financial Commitment

Before we explore the fallout of defaulting, let’s ground ourselves in what a bootcamp loan is. Coding bootcamps, intensive programs teaching skills like web development or data science, have surged in popularity. According to Course Report, over 33,000 students enrolled in U.S. bootcamps in 2023, with tuition averaging $13,500. Many students can’t pay upfront, so loans become the bridge to their tech dreams.

What Are Bootcamp Loans?

Bootcamp loans are typically private loans or financing agreements designed to cover tuition. Unlike federal student loans, they’re offered by private lenders like Climb Credit, Ascent Funding, or even the bootcamp itself through income share agreements (ISAs). Interest rates often range from 8% to 15%, and repayment terms span 2-5 years. ISAs, by contrast, require you to pay a percentage of your income (e.g., 15% for 3 years) once you earn above a threshold, like $50,000 annually.

Why Are Bootcamp Loans Risky?

Unlike federal loans, bootcamp loans lack protections like income-driven repayment or forgiveness programs. If you lose your job or earn less than expected, payments don’t adjust. In 2024, a LinkedIn study found that 30% of bootcamp grads took over six months to land a tech job, increasing default risks. This vulnerability sets the stage for what happens when payments are missed.

Now that we understand the stakes, let’s define what it means to default on bootcamp loan.

What Does Defaulting on Bootcamp Loan Mean?

Defaulting isn’t just missing a payment—it’s a serious financial misstep with lasting ripples. Picture Sarah, a 28-year-old who joined a bootcamp to pivot from retail to tech. She borrowed $12,000 but struggled to find work. After months of missed payments, her loan entered default. Sarah’s story isn’t unique, but it illuminates the process.

Defining Default and Delinquency

A loan becomes delinquent the moment a payment is missed. Lenders typically report delinquency to credit bureaus after 30 days, dinging your credit score. Default, however, occurs after prolonged non-payment—usually 270 days for private loans, though some bootcamp lenders set shorter timelines (e.g., 120 days). Once defaulted, the loan is considered unrecoverable by the lender, triggering aggressive recovery actions.

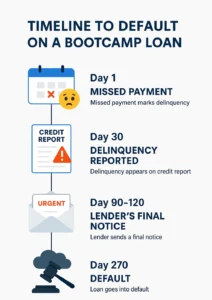

The Timeline to Default

• Day 1: Payment missed; loan becomes delinquent.

• Day 30: Delinquency reported to credit bureaus (Equifax, Experian, TransUnion).

• Day 90-120: Lender may offer a final chance to catch up or modify terms.

• Day 270 (or earlier): Loan defaults; debt may be sent to collections.

Data Point: A 2023 Experian report noted that private loan defaults, including bootcamp loans, increased by 12% post-pandemic, reflecting economic pressures.

So, what happens when a loan officially defaults? The consequences are far-reaching, as we’ll see next.

The Consequences of Defaulting on Bootcamp Loan: A Cascade of Challenges

Defaulting on bootcamp loan isn’t a single event—it’s a domino effect that touches every corner of your financial life. Let’s break down the fallout, backed by data and real stories.

Credit Score Devastation: A Long-Lasting Blow

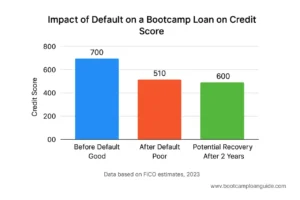

Your credit score, a three-digit number dictating your borrowing power, takes a brutal hit when you default on bootcamp loan. According to FICO, a single default can slash your score by 100-200 points. For someone with a 700 score (considered “good”), this could drop them to the “poor” range (below 580). The consequences of defaulting on a loan, as outlined by the Consumer Financial Protection Bureau, include a significant credit score drop, often by 100-200 points, which can persist for seven years.

How It Impacts You

- • Higher Borrowing Costs: Future loans, like car loans or mortgages, come with steeper interest rates—or may be denied outright.

- • Renting Challenges: Landlords often check credit, and a low score could lead to rejected applications.

- • Job Prospects: Some tech employers, especially in fintech, review credit during hiring. A 2022 SHRM survey found 34% of employers check credit for certain roles.

Case Study: Meet James, a 32-year-old bootcamp grad from Seattle. After defaulting on a $10,000 loan in 2023, his credit score plummeted from 680 to 510. He was denied an apartment lease and struggled to refinance other debts. “It felt like I was trapped,” James shared in a Reddit thread. His story underscores the hidden toll of default.

Collection Actions: The Pressure Mounts

Once a bootcamp loan defaults, it may be sent to collections, where debt collection practices, as regulated by the Federal Trade Commission, can lead to wage garnishment or bank account levies. The Federal Trade Commission (FTC) reports that 28% of Americans with debt in collections faced harassment in 2023.

What to Expect

- Constant Communication: Collectors may call multiple times daily, though the Fair Debt Collection Practices Act (FDCPA) limits abusive tactics.

- Added Fees: Collection agencies tack on fees, sometimes 25-50% of the original debt, inflating what you owe.

- Credit Report Stain: The default stays on your credit report for seven years, even if you settle the debt.

Historical Example: In the 2008 financial crisis, private student loan defaults spiked, and collection agencies thrived. Bootcamp loans, while newer, follow a similar playbook, with agencies like Performant Recovery targeting defaulters.

Legal Risks: From Lawsuits to Wage Garnishment

If collection efforts fail, lenders may sue. A 2024 National Consumer Law Center report found that 15% of private loan defaults led to lawsuits, with judgments allowing wage garnishment or bank account levies.

Real-World Impact

- Wage Garnishment: Up to 15% of your disposable income can be garnished, per federal law.

- Bank Account Seizure: Courts may freeze or seize funds from your accounts.

- Legal Fees: You could owe court costs, further ballooning the debt.

Story: Maria, a single mom in Chicago, defaulted on a $14,000 bootcamp loan in 2022. After ignoring collection notices, she faced a lawsuit. The court ordered 10% of her wages garnished, leaving her struggling to cover rent. “I wish I’d negotiated earlier,” she told a local news outlet. Maria’s ordeal highlights the stakes.

Career and Emotional Toll: Beyond the Numbers

Defaulting isn’t just financial—it’s personal. The stress of dodging collectors or losing income can strain mental health. A 2023 American Psychological Association study linked debt stress to higher rates of anxiety and depression.

Tech Career Implications

- Employer Scrutiny: As noted, some tech firms check credit, especially for roles handling sensitive data.

- Lost Opportunities: A low credit score might block you from certifications or further education requiring loans.

- Confidence Hit: The shame of default can sap motivation, hindering job search efforts.

The consequences are daunting, but default isn’t a dead end. Let’s explore how to respond if you’re at risk.

What to Do If You’re at Risk of Defaulting: Proactive Steps to Regain Control

If you’re struggling to make payments, don’t wait for default. Acting early can save your credit and peace of mind. Here’s how to navigate the storm, inspired by real success stories.

Contact Your Lender Immediately

Lenders want to avoid default as much as you do—it’s costly for them too. Many offer temporary relief options.

Options to Explore

- • Forbearance: Pause payments for 3-6 months, though interest may accrue.

- • Deferment: Delay payments if you’re unemployed or in financial hardship.

- • Modified Repayment: Extend the loan term or lower monthly payments.

Data: A 2024 Climb Credit survey found that 60% of borrowers who requested relief avoided default.

Story: Take Alex, a 27-year-old bootcamp grad. Facing unemployment in 2023, he contacted his lender, Ascent Funding, and secured a six-month forbearance. “It gave me breathing room to land a junior developer role,” he shared on X. Alex’s proactive approach paid off.

Refinance or Consolidate Your Loan

If your credit is still decent, refinancing can lower your interest rate or payments. Consolidation combines multiple loans into one, simplifying repayment.

How It Works

- Refinancing: Replace your loan with a new one at better terms (e.g., 7% instead of 12%).

- Consolidation: Merge loans into a single payment, often with a longer term to reduce monthly costs.

- Caution: Refinancing requires a solid credit score, which may be tough if you’re already delinquent.

Boost Income or Cut Expenses

Sometimes, the solution lies in your budget. Side hustles or frugality can bridge the gap.

Practical Tips

Freelance Gigs: Platforms like Upwork or Fiverr let you leverage bootcamp skills for extra cash.

Budget Overhaul: Cut non-essentials like streaming subscriptions or dining out.

Emergency Fund: Redirect savings to loan payments temporarily.

Case Study: Priya, a 30-year-old bootcamp grad, faced $800 monthly loan payments in 2024. By freelancing on weekends and canceling subscriptions, she scraped together enough to stay current. “It was exhausting, but I avoided default,” she told a bootcamp alumni group.

Seek Professional Help

If you’re overwhelmed, credit counselors or financial advisors can guide you. Nonprofits like the National Foundation for Credit Counseling (NFCC) offer low-cost or free services.

What They Offer

• Debt Management Plans: Consolidate payments and negotiate lower rates.

• Budget Coaching: Build a sustainable financial plan.

• Legal Advice: Navigate lawsuits or collection disputes.

Prevention is always better than cure. Let’s look at how to avoid default from the start.

How to Avoid Defaulting on Bootcamp Loan: Lessons from the Past

The best way to handle default is to never face it. By learning from others’ mistakes and historical trends, you can make smarter choices.

Research Your Bootcamp and Loan Thoroughly

Not all bootcamps are equal. A 2023 Course Report study found that top-tier programs (e.g., General Assembly, Flatiron School) had job placement rates above 80%, while lesser-known ones dipped below 50%.

Key Questions to Ask

✓ What’s the job placement rate, and how is it verified?

✓ Are outcomes audited by a third party?

✓ What financing options are offered, and what are the terms?

Historical Lesson: In the early 2010s, for-profit colleges like ITT Tech lured students with high-interest loans and shaky job promises. Many defaulted, sparking lawsuits. Bootcamps aren’t identical, but the lesson holds: vet your program.

Understand Loan Terms and ISAs

Read the fine print. Traditional loans have fixed payments, while ISAs tie repayments to income, which can be a double-edged sword.

ISA Pros and Cons

• Pros: No payments if you’re unemployed or earn below the threshold.

• Cons: High earners may pay far more than the original loan.

Data: A 2024 Brookings Institution report found that 20% of ISA users paid over 1.5 times their borrowed amount due to high income later.

Build a Financial Safety Net

Before starting a bootcamp, save 3-6 months of living expenses. This cushion can cover loan payments during job searches.

How to Save

• Automate Savings: Set up monthly transfers to a high-yield savings account.

• Cut Luxuries: Skip vacations or big purchases pre-bootcamp.

• Side Hustles: Start freelancing early to build skills and savings.

Story: Liam, a 25-year-old bootcamp student, saved $5,000 before enrolling in 2023. When his job search stretched to eight months, those savings covered his $600 monthly loan payments. “I slept better knowing I had a buffer,” he said in a Medium post.

The Bigger Picture: Why Bootcamp Loan Defaults Matter

Defaulting on bootcamp loan isn’t just a personal crisis—it reflects broader trends in education and finance. The rise of bootcamps mirrors the gig economy’s growth, where quick skills promise quick rewards. But when promises fall short, defaults climb.

A Historical Parallel: The Student Loan Crisis

Bootcamp loans echo the broader student loan crisis. In 2024, U.S. student debt hit $1.7 trillion, with 7% of borrowers in default, per the Department of Education. Bootcamp loans, while smaller, follow a similar pattern: high hopes, high debt, and uneven outcomes.

The Role of Regulation

Unlike federal loans, bootcamp loans are lightly regulated. A 2024 Consumer Financial Protection Bureau (CFPB) report criticized predatory lending in the bootcamp space, calling for stricter oversight. Until reforms arrive, borrowers must self-advocate.

Frequently Asked Questions About Defaulting on Bootcamp Loan

To provide further clarity, we’ve compiled answers to common questions about what happens if you default on bootcamp loan. These insights will help you understand the risks and take proactive steps.

What Happens to Your Credit Score If You Default on Bootcamp Loan?

When a default on bootcamp loan occurs, your credit score can drop significantly—often by 100-200 points, according to FICO. This damage, reported to credit bureaus like Experian, lingers for seven years, making it harder to secure loans, rent apartments, or even land certain tech jobs. For example, a score of 700 could fall to the “poor” range (below 580), raising future borrowing costs. To mitigate this, contact your lender early to explore forbearance or modified repayment plans.

Can You Be Sued for Defaulting on Bootcamp Loan?

Yes, legal action is a real risk. If payments are consistently missed and the loan defaults, lenders may sell the debt to collection agencies, which can pursue lawsuits. A 2024 National Consumer Law Center report noted that 15% of private loan defaults, including bootcamp loans, led to court cases. Judgments may result in wage garnishment (up to 15% of income) or bank account levies. To avoid this, negotiate with your lender before the debt reaches collections.

How Long Does a Bootcamp Loan Default Stay on Your Credit Report?

A default on bootcamp loan remains on your credit report for seven years from the date of the first missed payment, per the Fair Credit Reporting Act. This mark can hinder your ability to borrow or rent. However, its impact lessens over time if you rebuild credit through timely payments on other accounts. Consulting a credit counselor, like those at the National Foundation for Credit Counseling, can help you recover faster.

What’s the Difference Between Delinquency and Default on Bootcamp Loan?

Delinquency happens when a payment is missed, typically reported to credit bureaus after 30 days, causing a minor credit score dip. Default, however, is triggered after prolonged non-payment—often 270 days for private loans, though some bootcamp lenders set shorter timelines (e.g., 120 days). A default on bootcamp loan escalates to collections and severe credit damage. To prevent default, act during delinquency by requesting payment relief from your lender. The U.S. Department of Education explains that loan delinquency and default differ in severity, with delinquency starting after 30 days and default often after 270 days of non-payment.

Can You Recover After Defaulting on Bootcamp Loan?

Absolutely, recovery is possible, though it takes effort. Start by negotiating a settlement with the lender or collection agency to pay a reduced amount. Alternatively, enroll in a debt management programs through a nonprofit like the National Foundation Credit Counseling. Rebuilding credit involves paying other bills on time and keeping credit card balances low. While a default on bootcamp loan is a setback, consistent financial discipline can restore your score over a few years.

Are Income Share Agreements (ISAs) Safer Than Traditional Bootcamp Loans?

ISAs, where you pay a percentage of your income after landing a job, can be safer for some. No payments are required if you earn below the income threshold (e.g., $50,000). However, high earners may pay more than the original loan amount, per a 2024 Brookings Institution report. Unlike traditional loans, Income Share Agreement rarely lead to default but carry unique risks. Research terms carefully to avoid surprises.

How Can You Avoid Defaulting on Bootcamp Loan?

To prevent a default on bootcamp loan, research bootcamps with high job placement rates (e.g., above 80%, per Course Report). Save 3-6 months of expenses before enrolling, and understand loan terms or ISAs fully. If payments become tough, contact your lender for forbearance or explore side hustles on platforms like Upwork. Proactive planning and communication are key to staying on track.

Let’s wrap up with hope and a call to action.

Conclusion: Charting a Path Forward

Defaulting on bootcamp loan can feel like a financial earthquake, shaking your credit, career, and confidence. From credit score drops to legal battles, the consequences are steep—but not insurmountable. By acting early, exploring relief options, and planning ahead, you can avoid or recover from default. Stories like Alex’s and Priya’s prove it’s possible to reclaim control. If you’re considering a bootcamp, research diligently and save aggressively. If you’re struggling with payments, don’t hide—reach out to your lender or a counselor today. Your tech dreams are worth fighting for, and financial missteps don’t define you. To stay proactive, explore financial literacy resources from Harvard University to better manage loans and avoid default.

Have you faced a default on bootcamp loan? Share your story in the comments or connect with a financial advisor at NFCC.org. Let’s build a community of support and solutions.

Your blog has become an indispensable resource for me. I’m always excited to see what new insights you have to offer. Thank you for consistently delivering top-notch content!

Thank you for taking the time to share such thoughtful feedback!

So glad you’re finding value here — your support keeps me going. Let me know if there’s something you’re itching to read about next. Cheers! 🎉