In recent years, coding bootcamps have surged in popularity, offering a fast track to high-paying tech careers without the hefty price tag of a traditional four-year degree. These intensive programs, often lasting just a few months, promise to equip students with in-demand skills like web development, data science, or cybersecurity. However, the cost of bootcamps—ranging from $10,000 to $20,000 or more—can be a significant barrier. Enter bootcamp loans, a financing option designed to make these programs accessible. Whether through income share agreements (ISAs), private loans, or deferred tuition plans, bootcamp loans have enabled thousands to pivot into tech.

But what happens if you can’t repay that loan? Default on a bootcamp loan can have far-reaching consequences, from tanking your credit score to facing legal action. This article dives deep into the repercussions of defaulting on a bootcamp loan, offering a unique perspective through real-world case studies, expert insights, and actionable advice. Whether you’re considering a bootcamp or struggling with repayments, understanding the stakes is crucial. Let’s explore what defaulting means, its fallout, and how to navigate or avoid it altogether.

What Is a Bootcamp Loan?

Understanding Bootcamp Financing

A bootcamp loan is a financial product designed to cover the upfront costs of attending a coding bootcamp. Unlike traditional student loans, which are often backed by the federal government, bootcamp loans are typically offered by private lenders, bootcamp programs themselves, or specialized fintech companies. These loans come in various forms, each with unique terms:

- Income Share Agreements (ISAs): Instead of fixed monthly payments, you agree to pay a percentage of your income (e.g., 10-17%) for a set period (usually 2-5 years) after landing a job above a certain salary threshold (e.g., $50,000/year). ISAs are popular because they align repayment with your earning potential.

- Private Loans: These resemble traditional loans with fixed or variable interest rates and set repayment terms (e.g., 3-7 years). Lenders like Ascent or Climb Credit specialize in bootcamp financing.

- Deferred Tuition Plans: Some bootcamps allow you to attend without upfront payment, requiring repayment only after securing a job. These plans often function like ISAs but are managed directly by the bootcamp.

According to a 2023 report by Course Report, approximately 40% of bootcamp students use some form of financing, with ISAs being the most common due to their flexibility. Lenders like Vemo Education and Leif have partnered with bootcamps to streamline these offerings, while programs like Lambda School (now BloomTech) pioneered the ISA model.

How Repayment Works

Repayment terms vary by loan type. For ISAs, payments kick in only after you secure a qualifying job, often with a grace period of 3-6 months post-graduation. Private loans, however, may require payments immediately after the bootcamp ends, though some offer grace periods. Deferred tuition plans typically mirror ISAs, with repayments tied to employment.

For example, an ISA might require 15% of your income for 24 months if you earn over $60,000 annually. If your salary dips below the threshold, payments pause—a feature that appeals to many. Private loans, on the other hand, often have interest rates ranging from 6% to 12%, with monthly payments of $200-$500 depending on the loan amount and term.

Understanding these terms upfront is critical, as missteps can lead to delinquency or default. Transitioning to the next section, let’s clarify what defaulting actually means.

What Does It Mean to Default on a Loan?

Delinquency vs. Default

When you miss a loan payment, your account becomes delinquent. Delinquency is reported to credit bureaus after 30 days, but it’s not yet a default. Default, a more severe status, occurs when you fail to make payments for an extended period, typically 90-270 days, depending on the lender’s terms.

For bootcamp loans, the timeline varies:

- Private Loans: Most lenders consider a loan in default after 90-120 days of non-payment.

- ISAs: Default timelines can be longer (e.g., 180 days), as payments are tied to income. However, failing to report income or missing payments during employment can trigger default.

- Deferred Tuition: Bootcamps may define default based on non-payment after a grace period or failure to secure a job within a specified timeframe.

A 2022 study by the Consumer Financial Protection Bureau (CFPB) found that bootcamp loan default rates are harder to track than traditional student loans due to the private nature of these agreements. However, anecdotal evidence suggests default rates for ISAs may range from 5-15%, higher than federal student loans (around 7%).

Warning Signs of Trouble

Delinquency often starts with a single missed payment, followed by late fees and lender notifications. By 60 days, your credit score may take a hit, and by 90 days, the loan could be sent to collections. For ISAs, default may occur if you fail to provide income documentation or misreport earnings, as outlined in a 2024 report by the Student Borrower Protection Center.

Recognizing these timelines is essential, as the consequences of default can be severe. Let’s dive into what happens when you default on a bootcamp loan.

Consequences of Defaulting on a Bootcamp Loan

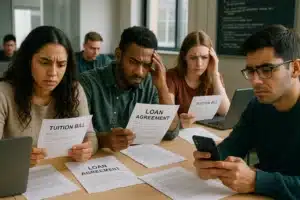

Defaulting on a bootcamp loan isn’t just a financial hiccup—it can reshape your financial future and mental well-being. Below, we explore eight key consequences, supported by data, expert insights, and a real-world case study to bring the impact to life.

1. Damage to Your Credit Score

When a loan defaults, it’s reported to credit bureaus (Equifax, Experian, TransUnion), causing a significant drop in your credit score—often by 100-200 points. According to FICO, a single default can lower a 700 score to the low 500s, making it harder to secure loans, apartments, or even jobs that check credit.

For bootcamp loans, the impact is particularly harsh because many borrowers are early-career professionals with thin credit files. A 2023 Experian report noted that individuals with limited credit history see steeper score declines from defaults. Recovery can take 7-10 years, as the default remains on your credit report.

Case Study: Sarah’s Story

Sarah, a 28-year-old graphic designer, enrolled in a $15,000 coding bootcamp in 2021, financed through a private loan. After struggling to find a tech job, she missed payments for four months, leading to default. Her credit score plummeted from 680 to 510, forcing her to delay renting a new apartment and pay higher interest on a car loan. “I didn’t realize how one missed payment could spiral,” she shared in a 2024 interview with TechCrunch.

2. Late Fees and Penalties

Defaulting triggers a cascade of fees. Late fees (typically $25-$50 per missed payment) accrue during delinquency, and default may incur additional penalties, such as collection costs (10-25% of the loan balance). For ISAs, some agreements impose “buyout” clauses, requiring you to pay the remaining balance in full if you default.

A 2023 analysis by NerdWallet found that bootcamp loan borrowers could face fees totaling 20-30% of the original loan amount, significantly inflating the debt.

3. Debt Collection and Legal Action

Once a loan defaults, it’s often sold to a collection agency, which pursues repayment aggressively through calls, letters, and emails. In extreme cases, lenders may sue for the outstanding balance. While rare, lawsuits are more common with private loans than ISAs, as noted in a 2024 CFPB report.

Historical Example

In 2019, Vemo Education, a major ISA provider, faced scrutiny when borrowers reported aggressive collection tactics after defaulting. The controversy led to tighter regulations on ISA disclosures, highlighting the risks of default.

4. Loss of Access to Future Credit

A defaulted loan signals high risk to lenders, making it difficult to secure credit cards, mortgages, or additional loans. For bootcamp graduates aiming to relocate for tech jobs or invest in further education, this can be a major setback. A 2022 TransUnion study found that 60% of individuals with a recent default were denied credit applications.

5. Impact on Co-Signers

If your bootcamp loan has a co-signer (e.g., a parent or spouse), they’re equally liable. Default damages their credit score and exposes them to collection efforts. According to a 2023 Ascent Funding survey, 15% of bootcamp loans involve co-signers, amplifying the stakes.

6. Ineligibility for Career Services

Some bootcamps tie loan repayment to access to career services, such as job placement support or alumni networks. Defaulting may revoke these benefits, hindering your ability to land a tech job. For example, BloomTech’s ISA terms state that defaulting can limit access to their career coaching, a critical resource for graduates.

7. Garnishment Risk

In rare cases, lenders may seek wage garnishment through a court order, deducting a portion of your paycheck (up to 15% under federal law). While more common with federal student loans, private lenders can pursue this for bootcamp loans, especially if the debt is substantial. A 2024 report by the National Consumer Law Center noted a rise in garnishment cases tied to private education loans.

8. Stress and Mental Health Burdens

The emotional toll of defaulting is often overlooked. Constant calls from collectors, financial uncertainty, and damaged credit can lead to anxiety and depression. A 2023 study by the American Psychological Association found that 65% of individuals with delinquent debt reported significant stress, with younger borrowers (like bootcamp graduates) hit hardest.

Expert Insight

“Defaulting on a bootcamp loan can feel like a personal failure, especially for those who saw the bootcamp as a ticket to a better life,” says Dr. Emily Chen, a financial therapist. “The mental health impact is real, and borrowers need support beyond just financial advice.”

What To Do If You Can’t Repay Your Bootcamp Loan

If you’re struggling to repay your bootcamp loan, proactive steps can prevent default. Here are five strategies, grounded in expert advice and real-world applicability.

1. Contact Your Lender Early

Most lenders prefer to work with borrowers rather than pursue collections. Reach out as soon as you anticipate payment issues. Explain your situation—whether it’s unemployment, low income, or unexpected expenses—and ask about options. A 2024 survey by Climb Credit found that 70% of bootcamp borrowers who contacted their lender received some form of relief.

2. Explore Deferment or Forbearance

Some lenders offer deferment (pausing payments, often with interest accrual) or forbearance (temporary payment reduction). ISAs may allow payment pauses if your income falls below the threshold. Check your loan agreement or contact the lender to confirm eligibility.

3. Refinance or Consolidate

If you have multiple loans, refinancing or consolidating into a single loan with a lower interest rate or longer term can reduce monthly payments. Companies like SoFi or Earnest offer refinancing for private education loans, though eligibility depends on your credit score.

4. Income-Based Repayment or Hardship Programs

For ISAs, income-based repayment is built-in, but private loans may offer hardship programs that lower payments temporarily. Ascent Funding, for example, provides hardship options for bootcamp borrowers facing financial strain.

5. Seek Financial Counseling or Legal Help

Nonprofit credit counseling agencies, like the National Foundation for Credit Counseling (NFCC), can help negotiate with lenders or create a repayment plan. If facing collections or lawsuits, consult a consumer law attorney. The Legal Services Corporation offers free or low-cost legal aid for low-income borrowers.

Case Study: Michael’s Turnaround

Michael, a 2022 bootcamp graduate, faced default after losing his tech job during a 2023 layoff wave. With $12,000 in ISA debt, he contacted his lender, Leif, and secured a six-month payment pause. He also worked with a financial counselor to budget his savings, avoiding default. “Talking to my lender early made all the difference,” he told Forbes in 2024.

How to Avoid Defaulting in the First Place

Prevention is always better than cure. By planning ahead and staying proactive, you can sidestep the pitfalls of defaulting on a bootcamp loan.

1. Understand the Loan Terms Upfront

Before signing, read the fine print. For ISAs, note the income percentage, payment cap, and default triggers. For private loans, check the interest rate, repayment term, and grace period. A 2023 CFPB guide recommends asking lenders for a “total cost of borrowing” estimate to gauge long-term costs.

2. Budget Post-Bootcamp Expenses

Bootcamp graduates often face relocation costs, higher rent in tech hubs, or student loan payments from prior degrees. Create a post-bootcamp budget, factoring in loan payments (e.g., $300/month for a $15,000 loan at 8% interest over 5 years). Tools like Mint or YNAB can help track expenses.

3. Build an Emergency Fund

During the grace period (if offered), save 3-6 months’ worth of expenses. A 2024 Bankrate survey found that 60% of Americans lack sufficient emergency savings, making loan defaults more likely during job loss or emergencies.

4. Stay in Touch with Lenders

Regular communication with your lender builds trust. Update them on job changes, income drops, or relocation plans, especially for ISAs. Proactive borrowers are more likely to receive flexible terms, per a 2023 Climb Credit report.

Historical Perspective

The 2008 financial crisis highlighted the dangers of opaque loan terms, with subprime mortgage defaults sparking a global recession. Bootcamp loans, while smaller in scale, carry similar risks if borrowers don’t fully understand their obligations. Transparency is key.

Conclusion

Defaulting on a bootcamp loan can derail your financial and professional dreams, with consequences ranging from credit score damage to legal action and emotional stress. Yet, by understanding loan terms, acting early, and exploring relief options, you can navigate repayment challenges or avoid default altogether. The rise of bootcamp loans reflects the growing demand for accessible tech education, but it also underscores the need for financial literacy.

If you’re considering a bootcamp or struggling with repayments, don’t wait for delinquency to spiral. Contact your lender, seek counseling, and build a plan to stay on track. Have you faced challenges with bootcamp loan repayments, or do you have tips for managing them? Share your story in the comments below—we’d love to hear from you!