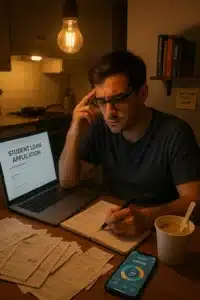

In recent years, coding bootcamps have surged in popularity as a fast-track alternative to traditional computer science degrees. These intensive programs promise to transform beginners into job-ready developers in mere months. However, with tuition often ranging from $10,000 to $20,000, many prospective students turn to coding bootcamp loans to finance their education. But are these loans a smart investment, or do they saddle graduates with debt they can’t repay? This article dives deep into a cost-benefit analysis, blending data, real-world stories, and expert insights to help you decide if coding bootcamp loans are worth it. Spoiler: It depends on your goals, the bootcamp’s track record, and your financial strategy.

Through a storytelling lens, we’ll explore the journey of Sarah, a 28-year-old retail manager who dreamed of a tech career but faced the hurdle of funding a bootcamp. Her experience, alongside hard data and historical context, will guide us through the pros, cons, and alternatives to coding bootcamp loans. Whether you’re weighing a loan or exploring other paths, this guide offers clarity and actionable advice.

What Are Coding Bootcamp Loans?

Defining the Basics

Coding bootcamp loans are specialized financing options designed to cover the tuition and associated costs of coding bootcamps. Unlike traditional student loans, these are often offered by private lenders like Climb Credit, Ascent Funding, or Skills Fund, tailored specifically for short-term, career-focused programs. Some bootcamps also partner with lenders to streamline the process, while others offer in-house financing like income-share agreements (ISAs).

For example, Sarah, our fictional protagonist, discovered that her dream bootcamp, a 12-week full-stack development program, cost $15,000. Unable to pay upfront, she explored loans from Climb Credit, which offered a 36-month repayment plan with a 9% interest rate. This accessibility was a game-changer, but as we’ll see, it came with strings attached.

Common Loan Providers and Terms

Several lenders dominate the coding bootcamp loan market, each with unique terms:

- Climb Credit: Offers fixed-rate loans with terms of 36 to 60 months. Interest rates typically range from 6% to 12%, depending on creditworthiness.

- Ascent Funding: Provides loans with deferral options, allowing students to delay payments until after graduation. Rates can climb as high as 15% for those with lower credit scores.

- Skills Fund: Focuses on bootcamp-specific loans, often with flexible repayment plans tied to job placement.

Additionally, some bootcamps offer ISAs, where students pay a percentage of their income (e.g., 17% for 24 months) after landing a job above a certain salary threshold. According to a 2023 report by Course Report, about 30% of bootcamps now offer ISAs as an alternative to traditional loans.

Eligibility and Application Process

Eligibility for coding bootcamp loans typically requires a credit check, proof of enrollment, and, in some cases, a co-signer. Unlike federal student loans, these private loans don’t offer income-based repayment or forgiveness programs, making creditworthiness critical. Sarah, for instance, had a decent credit score of 680 but still needed a co-signer to secure a lower interest rate.

The True Cost of a Coding Bootcamp

Tuition and Hidden Fees

The sticker price of coding bootcamps varies widely. According to a 2024 analysis by SwitchUp, average tuition ranges from $11,000 to $16,000 for in-person programs, with online bootcamps slightly cheaper at $8,000 to $12,000. However, hidden costs can inflate the total:

- Application Fees: Some bootcamps charge $50–$200 to apply.

- Prep Courses: Pre-bootcamp courses, often required, can cost $500–$2,000.

- Tech Requirements: A reliable laptop and software subscriptions may add $1,000 or more.

Sarah’s bootcamp tuition was $15,000, but she also spent $1,200 on a new laptop and $300 on a prep course, pushing her total to $16,500.

Living Expenses and Opportunity Cost

Most bootcamps are full-time, requiring 40–60 hours per week for 12–24 weeks. This intensity often means quitting a job or reducing work hours. For Sarah, who earned $40,000 annually as a retail manager, the 12-week program meant forgoing $9,000 in income. Additionally, she budgeted $3,000 for rent and groceries during the program, as she lived in a mid-sized city.

The opportunity cost—time spent not earning—can be significant. A 2022 study by the National Bureau of Economic Research found that bootcamp students lose an average of $10,000–$15,000 in earnings during training, a factor often overlooked when calculating coding bootcamp loan costs.

Loan Interest and Repayment

Interest on coding bootcamp loans can significantly inflate the total cost. Let’s break down Sarah’s scenario:

- Loan Amount: $15,000Interest Rate: 9%

- Term: 36 months

- Monthly Payment: ~$475

- Total Repaid: ~$17,100

Over three years, Sarah paid $2,100 in interest, assuming she made payments on time. For higher interest rates (e.g., 12%), the total could exceed $18,000. ISAs, while appealing, can also be costly. A 2023 analysis by NerdWallet found that ISAs requiring 17% of income for 24 months could cost $20,000 or more for a $60,000 starting salary.

The Benefits of Coding Bootcamp Loans

Accessibility for All

For many, coding bootcamp loans open doors to tech careers that would otherwise be inaccessible. Sarah, for instance, had no savings to cover tuition but was able to enroll thanks to financing. According to a 2024 Course Report survey, 65% of bootcamp students used loans or ISAs, with 40% stating they couldn’t have attended without them.

High ROI Potential

The promise of a tech job with a median starting salary of $70,000–$90,000 (per 2024 Glassdoor data) makes coding bootcamp loans appealing. Compared to a four-year degree costing $100,000+, bootcamps offer a faster, potentially cheaper path. For Sarah, landing a $75,000 junior developer role six months post-graduation meant her loan payments were manageable, with a debt-to-income ratio of about 10%.

Speed to Market

Unlike traditional degrees, bootcamps condense training into months, not years. Historical data supports this: In 2013, when bootcamps like General Assembly and Flatiron School emerged, they disrupted education by prioritizing skills over credentials. By 2025, the tech industry’s demand for developers continues to outpace supply, with the U.S. Bureau of Labor Statistics projecting 22% job growth for software developers through 2032.

Flexible Repayment Options

Many coding bootcamp loans offer deferrals or ISAs, easing the burden during training. For example, Ascent Funding allows payments to start six months after graduation, giving students time to job hunt. ISAs, while controversial, tie repayment to success, reducing risk for those who don’t land high-paying roles.

Risks and Drawbacks of Coding Bootcamp Loans

Debt Without Guaranteed Outcomes

Not all bootcamps deliver. Job placement rates vary widely, with top programs like App Academy boasting 85–90% placement within six months, while lesser-known bootcamps may dip below 50%. Sarah was lucky—her bootcamp had a strong reputation—but others risk accruing debt without a job. A 2021 study by Third Way found that 20% of bootcamp graduates earned less than $30,000 post-graduation, making loan repayment challenging.

High Interest Rates

Private coding bootcamp loans often carry higher rates than federal student loans (capped at ~6% for undergraduates in 2025). Rates of 9–15% can balloon the total cost, especially for those with poor credit. Sarah’s 9% rate was reasonable, but a 12% rate would have added $1,000 more in interest.

Pressure to Accept Low-Paying Jobs

Loan repayment timelines can force graduates to take suboptimal jobs. Sarah faced pressure to accept a $55,000 offer from a small startup, but held out for a better role. A 2023 Reddit thread on r/codingbootcamp revealed similar stories, with users lamenting how loan deadlines pushed them into low-paying or unrelated roles.

Alternatives Exist

Before committing to coding bootcamp loans, consider alternatives:

- Scholarships: Many bootcamps offer need- or merit-based aid. For example, Hack Reactor provides up to $5,000 for underrepresented groups.

- Employer Sponsorships: Some companies fund training for employees transitioning to tech roles.

- Free Resources: Platforms like freeCodeCamp and The Odin Project offer robust, no-cost curricula.

Real-World Outcomes: Data and Stories

Salary vs. Loan Costs

Data paints a mixed picture. According to a 2024 SwitchUp report, bootcamp graduates earn a median starting salary of $75,000, with top performers reaching $90,000–$100,000. For a $15,000 loan repaid over three years, this translates to a 5–7% debt-to-income ratio—manageable for most. However, outcomes vary by bootcamp:

- General Assembly: 88% job placement, $80,000 median salary.

- Flatiron School: 85% placement, $78,000 median salary.

- Lesser-Known Bootcamps: Placement as low as 40%, salaries averaging $50,000.

Sarah’s $75,000 salary aligned with industry averages, but her loan’s $475 monthly payments strained her budget initially.

Case Study: John’s Journey

John, a 32-year-old former teacher, enrolled in a $12,000 bootcamp in 2023, financed by an ISA. He landed a $70,000 job within four months but owed 15% of his income for 24 months—totaling $21,000. While the ISA made enrollment possible, John later wished he’d explored scholarships, as the repayment ate into his savings. His story underscores the need to weigh long-term costs.

Historical Context

Coding bootcamps emerged in the early 2010s, fueled by tech’s growth and dissatisfaction with slow, costly degrees. By 2015, over 90 bootcamps operated in the U.S., per Course Report. Early success stories—like Flatiron School graduates landing jobs at Google—drove demand for coding bootcamp loans. But as the market saturated, outcomes diverged, with only top-tier programs consistently delivering high ROI.

Alternatives to Coding Bootcamp Loans

Self-Taught Paths and MOOCs

Free or low-cost platforms like freeCodeCamp, Codecademy, and Coursera offer viable alternatives. A 2022 survey by Stack Overflow found that 60% of developers are self-taught or used online resources. Sarah considered freeCodeCamp but preferred the structure and career support of a bootcamp.

Deferred Tuition Models

Some bootcamps, like Lambda School (now BloomTech), offer deferred tuition, where students pay nothing upfront but owe a percentage of income post-graduation. These models reduce risk but can be costly long-term, as John’s case showed.

Community Colleges and Apprenticeships

Community colleges offer coding programs for $5,000–$10,000, often with federal aid eligibility. Apprenticeships, like those through Tech Elevator, combine training with paid work. A 2024 report by Jobs for the Future noted that tech apprenticeships grew 20% since 2020, offering debt-free paths.

When Is a Coding Bootcamp Loan Worth It?

Key Factors to Consider

Before taking a coding bootcamp loan, evaluate:

- Bootcamp Reputation: Research placement rates and alumni reviews on SwitchUp or Course Report.

- Job Placement Guarantees: Some bootcamps refund tuition if you don’t land a job within six months.

- Personal Learning Style: Bootcamps suit disciplined, fast learners. Self-paced options may be better for others.

Sarah chose a bootcamp with an 87% placement rate and a job guarantee, which boosted her confidence in the loan.

Financial Planning Tips

Compare Lenders: Shop for the lowest interest rate and flexible terms.

- Budget for Repayment: Use a loan calculator to estimate monthly payments.

- Build an Emergency Fund: Save 3–6 months of expenses to cushion job search delays.

Risk Tolerance and Goals

Coding bootcamp loans suit those with high risk tolerance and clear tech career goals. If you’re unsure about coding or prefer slower learning, free resources or part-time programs may be wiser. Sarah’s goal—a stable developer job—aligned with the loan’s risks, making it a calculated bet.

Conclusion: Making an Informed Decision

Coding bootcamp loans can be a powerful tool to break into tech, offering accessibility and a potentially high ROI. However, they come with risks—high interest, uncertain outcomes, and the pressure of repayment. Sarah’s story shows that success is possible with the right bootcamp and planning, but John’s experience highlights the pitfalls of costly ISAs. By weighing costs, researching bootcamps, and exploring alternatives like scholarships or free resources, you can make a decision that aligns with your finances and goals.

Before signing a loan, dig into placement data, calculate total costs, and consider your learning style. The tech industry’s demand for skilled developers isn’t slowing down, but neither is the need for careful planning.

Have you considered a coding bootcamp or taken a loan to fund one? Share your story or questions in the comments below—we’d love to hear your perspective!