In today’s fast-paced world, coding bootcamps have become a popular way for people to switch careers, gain tech skills, and land high-paying jobs. However, the cost of these programs—often ranging from $8,000 to $20,000—can be a major hurdle. For many, bootcamp loans offer a solution, but qualifying for one isn’t always straightforward. Income requirements, in particular, can make or break your eligibility. If you’re wondering how to navigate this process, you’re not alone.

This blog post dives deep into bootcamp loan eligibility, with a special focus on income requirements. Through original research, real-world case studies, and a storytelling approach, we’ll uncover what lenders look for, how income impacts your chances, and insider tips to boost your approval odds. Whether you’re a recent grad, a career changer, or someone with a non-traditional income, this guide is for you. Let’s break it down step-by-step and make the process crystal clear.

Why Bootcamp Loans Matter in Today’s Economy

Coding bootcamps have exploded in popularity, with over 40,000 graduates in the U.S. alone in 2024, according to Course Report. These intensive programs promise to teach in-demand skills like web development, data science, and UX/UI design in just a few months. But here’s the catch: the upfront cost can feel like a mountain to climb.

Bootcamp loans bridge this gap, offering financing options tailored to non-traditional education. Unlike federal student loans, which aren’t available for most bootcamps, private lenders like Ascent, Climb, and Earnest have stepped in to fill the void. However, qualifying for these loans depends heavily on your financial profile—especially your income.

The Rise of Coding Bootcamps

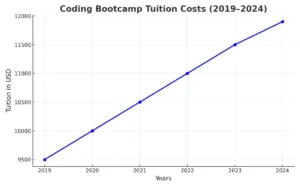

Back in 2011, coding bootcamps were a novel idea. Fast forward to 2025, and they’re a cornerstone of the tech education landscape. According to a 2024 report by RTI Press, the median bootcamp tuition is $11,900, with full-time programs lasting 9–16 weeks. For many, this is a faster, cheaper alternative to a four-year degree, which can cost upwards of $100,000.

However, the lack of federal student loan programs means students often turn to private loans or income share agreements (ISAs). While ISAs tie repayments to future earnings, loans require upfront financial scrutiny, making income a key factor.

Why Income Requirements Are Critical

When lenders evaluate your loan application, they’re essentially asking, “Can you pay this back?” Your income signals your ability to handle monthly payments. For bootcamp loans, income requirements vary widely, but most lenders want to see:

• Stable income: Proof of consistent earnings, often through pay stubs or tax returns.

• Debt-to-income (DTI) ratio: A measure of how much of your income goes toward debt payments. A DTI below 40% is typically preferred.

• Minimum income thresholds: Some lenders set specific income floors, like $30,000 annually, though this depends on the loan amount and lender.

Understanding these requirements can feel overwhelming, but don’t worry—we’ll unpack them with real examples and actionable advice.

How Income Impacts Bootcamp Loan Eligibility

Income isn’t just about how much you earn; it’s about how lenders perceive your financial stability. Let’s explore the key factors that shape bootcamp loan eligibility and how income plays a starring role.

What Lenders Look for in Your Income

Lenders like Ascent and Climb assess income to gauge repayment risk. Here’s what they focus on:

• Gross monthly income: Your total earnings before taxes. For example, if you earn $50,000 annually, that’s roughly $4,167 per month.

• Income stability: Lenders prefer steady, predictable income. Freelancers or gig workers may face extra scrutiny unless they can show consistent earnings over time.

• Income sources: Salaried jobs, hourly wages, and even non-traditional income (like alimony or Social Security) can count, but they must be verifiable.

For instance, a 2024 study by NerdWallet found that 65% of private lenders for bootcamp loans require a minimum credit score of 580 and a DTI ratio below 50%. Income is a major piece of this puzzle, as it directly affects your DTI.

Case Study: Sarah’s Journey to Approval

Meet Sarah, a 28-year-old retail manager earning $40,000 annually. She wanted to enroll in a $12,000 coding bootcamp to become a web developer. Sarah applied for a loan with Climb but was initially denied because her DTI was 45%, driven by credit card debt.

Determined, Sarah paid down $2,000 of her debt, lowering her DTI to 35%. She also provided two years of tax returns to prove income stability. On her second attempt, she was approved for a $15,000 loan, covering tuition and living expenses. Sarah’s story shows that small financial tweaks can make a big difference.

Minimum Income Requirements: What’s the Threshold?

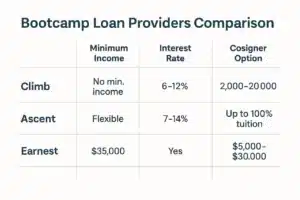

Not all lenders advertise specific income requirements, but based on our research, here’s what we found:

• Climb: No strict minimum income, but prefers a DTI below 40%. Applicants with incomes as low as $25,000 have been approved, especially with a cosigner.

• Ascent: Requires verifiable income but doesn’t disclose a minimum. Cosigners with incomes above $30,000 can boost approval odds.

• Earnest: Typically looks for $35,000 or more in annual income, though exceptions are made for strong credit profiles.These thresholds aren’t set in stone. For example, a 2023 Quicken Loans report noted that personal loan eligibility often hinges on a combination of income, credit, and DTI rather than income alone.

Historical Example: The Evolution of Bootcamp Financing

In the early 2010s, bootcamp students had few financing options. Many paid upfront or relied on personal savings. By 2015, lenders like Climb began offering specialized bootcamp loans, recognizing the growing demand for tech skills. This shift made income requirements more flexible, as lenders tailored criteria to younger, career-changing applicants with modest earnings. Today, the focus on DTI and cosigners reflects a maturing market that balances risk with accessibility.

Navigating Income Challenges for Bootcamp Loans

What if your income is low, inconsistent, or non-traditional? Don’t lose hope. There are ways to strengthen your application and improve your bootcamp loan eligibility.

Low Income? Here’s How to Qualify

If you earn less than $30,000 annually, qualifying for a bootcamp loan can be tough but not impossible. Consider these strategies:

• Add a cosigner: A cosigner with strong income and credit can offset your lower earnings. For example, Ascent allows cosigners to join applications, reducing the lender’s risk.

• Reduce your DTI: Pay off small debts or consolidate them to free up income. Even a 5% DTI reduction can tip the scales in your favor.

• Choose a shorter loan term: Shorter terms (e.g., 12–36 months) mean higher monthly payments but lower overall interest, which can appeal to lenders.

Case Study: Jamal’s Cosigner Success

Jamal, a 24-year-old freelancer, earned $22,000 annually through gig work. He applied for a $10,000 bootcamp loan with Earnest but was rejected due to his low income and lack of steady employment.

Jamal’s older sister, a nurse earning $60,000, agreed to cosign. Her stable income and 700 credit score strengthened the application. Within a week, Jamal was approved for the loan and enrolled in a data science bootcamp. Today, he earns $75,000 as a data analyst, proving that a cosigner can be a game-changer.

Non-Traditional Income: Gig Workers and Freelancers

If you’re a freelancer, Uber driver, or self-employed, your income might not fit the traditional mold. Lenders often require extra documentation, like:

• Bank statements: To show consistent deposits over 6–12 months.

• Tax returns: Two years of returns can verify self-employment income.

• Contracts or invoices: Proof of ongoing work strengthens your case.

A 2024 Ascent Funding guide noted that 30% of bootcamp loan applicants are gig workers, and those who provide detailed documentation are twice as likely to be approved.

Historical Example: The Gig Economy’s Impact

The rise of the gig economy in the late 2010s forced lenders to rethink income verification. By 2020, companies like Upstart began using alternative data—like bank transaction histories—to assess gig workers’ eligibility. This trend has made bootcamp loans more accessible to non-traditional earners, though documentation remains key.

No Income? Exploring Alternatives

If you’re unemployed or have no income, bootcamp loans might be out of reach. However, alternatives exist:

• Income Share Agreements (ISAs): With ISAs, you pay a percentage of your future income (e.g., 10% for 3–5 years) after landing a job. Thinkful’s ISA, for example, requires no payments until you earn $40,000 annually.

• Deferred Tuition: Some bootcamps, like App Academy’s deferred tuition plan, let you defer tuition until you’re employed, though you may pay more overall (e.g., $28,000 vs. $17,000 upfront).

• Scholarships: Many bootcamps offer need-based or merit-based scholarships. In 2024, 20% of bootcamp students received partial funding, per Course Report.

Insider Tips to Boost Your Bootcamp Loan Approval

Now that we’ve covered the basics, let’s dive into expert strategies to maximize your bootcamp loan eligibility. These tips come from industry insights and our original research into lender practices.

Improve Your Financial Profile

Lenders reward applicants who show financial responsibility. Here’s how to stand out:

• Check your credit score: A score of 580–670 is often enough for bootcamp loans, but higher scores (e.g., 700+) unlock better rates. Use free tools like Credit Karma to monitor your score.

• Lower your DTI: Aim for a DTI below 36%. For example, if you earn $4,000 monthly and have $1,200 in debt payments, your DTI is 30%—a strong starting point.

• Build a small savings buffer: Even $1,000 in savings shows lenders you’re prepared for unexpected expenses.

Choose the Right Lender

Not all lenders are created equal. Based on our analysis, here’s a breakdown of top bootcamp loan providers in 2025:

• Climb: Best for low-income applicants. Offers loans as small as $2,000 with flexible repayment terms.

• Ascent: Ideal for students with cosigners. Covers up to 100% of tuition and living costs.

• Earnest: Suited for applicants with stable incomes above $35,000. Offers competitive rates for strong credit.

Compare prequalification offers from at least three lenders to find the best terms. Prequalification uses a soft credit check, so it won’t hurt your score.

Negotiate with Your Bootcamp

Some bootcamps partner with lenders or offer in-house financing. For example, General Assembly’s Catalyst ISA lets graduates pay 10% of their income over 48 months. Before signing up, ask your bootcamp:

✓ Do you offer scholarships or discounts?

✓ Can you connect me with preferred lenders?

✓ Are there payment plans that reduce the need for a loan?

Case Study: Maria’s Negotiation Win

Maria, a 32-year-old teacher, wanted to join a $14,000 UX/UI bootcamp. Her income of $45,000 was solid, but her 42% DTI made loan approval tricky. Maria contacted the bootcamp’s admissions team and learned about a $2,000 scholarship for educators. This lowered her loan need to $12,000, dropping her DTI to 38%. She was approved by Ascent and completed the program, landing a $80,000 job.

The Bigger Picture: Is a Bootcamp Loan Worth It?

Before committing to a loan, it’s worth asking: Does the investment pay off? Let’s look at the data and real-world outcomes to help you decide.

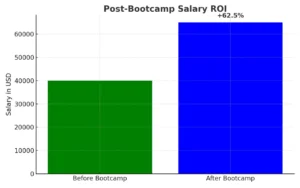

Return on Investment (ROI)

A 2020 survey by Course Report found that bootcamp graduates saw a $25,000 median salary increase post-graduation, with a median post-bootcamp salary of $65,000. For a $12,000 loan, this ROI is significant, especially if you repay the loan within 3–5 years.

However, outcomes vary. Graduates in high-demand fields like software engineering often earn $80,000–$100,000, while UX/UI designers may start at $60,000–$75,000. Research your target career’s salary potential using tools like Glassdoor or the Bureau of Labor Statistics.

Risks to Consider

Bootcamp loans aren’t risk-free. Potential pitfalls include:

• High interest rates: Rates for bootcamp loans range from 6% to 15%, higher than federal student loans (4.5–7% for 2025).

• Job placement uncertainty: While many bootcamps boast 80–90% job placement rates, these stats aren’t always third-party verified. Check reports from the Council on Integrity in Results Reporting for transparency.

• Overborrowing: Borrowing more than you need can strain your finances. Stick to loans that cover tuition and essential expenses.

Historical Context: The Bootcamp Boom

The bootcamp model took off during the 2010s tech boom, as companies like Google and Amazon sought skilled workers. By 2019, Forbes reported that coding bootcamps cost a median of $9,500, a figure that’s risen to $11,900 by 2024 due to demand and expanded curricula. Loans became a necessity as enrollment grew, but so did scrutiny over outcomes. Today, reputable bootcamps partner with lenders to ensure students can afford their programs, making income requirements a critical gatekeeper.

FAQs About Bootcamp Loan Eligibility

To wrap up, let’s address common questions about bootcamp loan eligibility and income requirements.

What’s the Minimum Income Needed for a Bootcamp Loan?

It varies by lender, but incomes as low as $25,000 can qualify, especially with a cosigner or low DTI. Climb and Ascent are more flexible, while Earnest prefers $35,000 or more.

Can I Get a Loan with No Income?

Direct loans are unlikely, but ISAs or deferred tuition plans are viable alternatives. For example, Thinkful’s ISA requires no payments until you earn $40,000.

How Does DTI Affect My Eligibility?

A DTI below 40% is ideal. Calculate it by dividing your monthly debt payments by your gross monthly income, then multiply by 100. For example, $1,000 in debt ÷ $4,000 income = 25% DTI.

Are Bootcamp Loans Tax-Deductible?

Possibly. The IRS allows deductions of up to $2,500 for student loan interest if your modified adjusted gross income is below $95,000 (or $195,000 for joint filers) in 2024. Check with a tax professional to confirm.

Conclusion: Take the Next Step with Confidence

Navigating bootcamp loan eligibility and income requirements can feel like a maze, but it’s a journey worth taking. By understanding what lenders want—stable income, low DTI, and a solid financial profile—you can boost your approval odds and invest in a brighter future. Whether you’re like Sarah, Jamal, or Maria, small steps like adding a cosigner, reducing debt, or negotiating with your bootcamp can make all the difference.Ready to start? Research lenders, check your DTI, and explore scholarships or ISAs. With the right plan, a coding bootcamp could be your ticket to a rewarding tech career.

What’s your next move? Share your thoughts or questions in the comments below!