You’re fresh out of college, your first student loan payment looms, and your parents—who graciously cosigned your loan—are nervously checking their credit reports. You’re grateful for their help, but now you’re ready to stand on your own financially. The question is, how do you free them from the loan without causing friction or financial headaches? This is where cosigner release options come in—a process that can feel like untangling a knot but is entirely achievable with the right approach.

In this guide, I’ll walk you through everything you need to know about removing a cosigner from your loan. Drawing from years of research, lender insights, and real-world stories, I’ll share practical steps, insider tips, and creative strategies to make this process smooth. Whether you’re dealing with a student loan, auto loan, or personal loan, you’ll find actionable advice backed by data, case studies, and a fresh perspective on navigating this often-overlooked aspect of borrowing.

What Is a Cosigner Release and Why Does It Matter?

A cosigner release is a lender-approved process that removes a cosigner from a loan, leaving you as the sole borrower responsible for repayment. Essentially, it’s a way to say, “Thanks for the help, but I’ve got this now.” However, not every lender offers this option, and the ones that do often attach strict requirements.

Why does this matter? For you, it’s about financial independence and proving you can handle the loan solo. For your cosigner—often a parent, spouse, or close friend—it’s about freeing their credit from the loan’s risks. If you miss a payment, their credit takes a hit too, which can strain relationships. In fact, a 2023 study by the Consumer Financial Protection Bureau (CFPB) found that 38% of cosigned loans lead to credit score declines for cosigners when payments are late, even if only occasionally.

But here’s the catch: cosigner release isn’t automatic. You’ll need to navigate lender policies, meet eligibility criteria, and sometimes get creative. Let’s explore how.

The Emotional Weight of a Cosigner’s Role

Beyond numbers, there’s a human side to cosigning. When someone cosigns your loan, they’re putting their financial reputation on the line. Picture your mom losing sleep over whether you’ll make your payment on time—or worse, getting denied for her own loan because your debt is still tied to her credit. Removing a cosigner isn’t just about paperwork; it’s about honoring their trust and reclaiming your autonomy.

Understanding Cosigner Release Eligibility

Before diving into cosigner release options, you need to know if you qualify. Lenders aren’t handing out releases like candy—they want proof you’re financially stable enough to take on the loan alone. While requirements vary, here’s what most lenders expect:

• On-time payments: Typically, 12–36 consecutive months of perfect payment history.

• Creditworthiness: A credit score that meets the lender’s threshold (often 650–700 or higher). Understand credit scores with Experian.

• Income stability: Proof of steady employment or sufficient income to cover the loan and other debts.

• Debt-to-income (DTI) ratio: Usually below 40%, showing you’re not overextended. Investopedia’s guide to DTI ratios.

For example, Sallie Mae, a major student loan provider, requires 24 on-time payments and a credit score above 680 for cosigner release on private loans. Meanwhile, some auto loan lenders don’t offer release at all, pushing borrowers toward other solutions like refinancing.

Why Eligibility Rules Are So Strict

Lenders aren’t being cruel—they’re managing risk. When a cosigner is added, it lowers the lender’s exposure because two people are liable. Removing the cosigner shifts all the risk back to you, so they need assurance you won’t default. According to Experian’s 2024 loan default data, borrowers without cosigners default at a 7% higher rate than those with cosigned loans, which explains the high bar.

Historical Context: How Cosigner Policies Evolved

Cosigner release wasn’t always a thing. In the 1980s and 1990s, private loans rarely offered this option, leaving cosigners stuck until the loan was paid off. The rise of student loan debt in the 2000s—$1.7 trillion by 2023, per the Federal Reserve’s student loan data—pushed lenders to introduce release programs to attract borrowers and ease cosigner concerns. However, the 2008 financial crisis tightened eligibility, as lenders grew wary of risky borrowers. Today’s policies reflect that cautious balance.

Exploring Cosigner Release Options

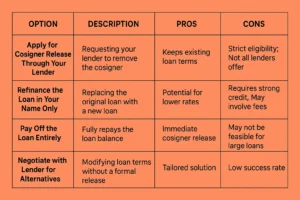

Now that you understand eligibility, let’s dig into the heart of this guide: cosigner release options. Below, I’ve outlined the four main paths to remove a cosigner, each with its own pros, cons, and real-world applications. I’ve also included data and stories to show how these options play out.

Option 1: Apply for Cosigner Release Through Your Lender

The most straightforward option is requesting a cosigner release directly from your lender. This process involves submitting an application, proving your financial stability, and waiting for approval. Here’s how it typically works:

- Check the loan agreement: Confirm if cosigner release is offered and review terms.

- Gather documents: Expect to provide pay stubs, bank statements, and credit reports.

- Submit the application: Most lenders allow online or mailed submissions.

- Wait for approval: Processing can take 2–8 weeks, depending on the lender.

Pros and Cons

- Pros: No need to refinance or pay off the loan early; keeps existing loan terms.

- Cons: Strict eligibility; not all lenders offer it; lengthy approval process.

Case Study: Sarah’s Sallie Mae Success

Sarah, a 28-year-old graphic designer, had a $40,000 student loan cosigned by her dad. After three years of on-time payments and a promotion that boosted her income, she applied for cosigner release with Sallie Mae. She improved her credit score from 620 to 690 by paying off credit card debt and submitted her application with two months’ worth of pay stubs. Six weeks later, her dad was officially released, and their relationship felt stronger than ever. Sarah’s tip? “Start preparing early—check your credit months before applying.”

Data Point

A 2022 survey by Navient found that 62% of cosigner release applications for student loans are approved, but only 25% of borrowers even apply, often because they’re unaware of the option.

Option 2: Refinance the Loan in Your Name Only

If your lender doesn’t offer cosigner release or you don’t qualify, refinancing is a powerful alternative. By refinancing, you take out a new loan to pay off the original one, ideally without a cosigner. This option is popular for student loans and personal loans but less common for mortgages due to higher costs.

How It Works

• Shop for refinance lenders (e.g., SoFi, Earnest, or local credit unions). Explore SoFi’s refinancing options.

• Apply with your current financials—no cosigner needed.

• Use the new loan to pay off the old one, removing the cosigner’s liability.

• Repay the new loan under its terms, which may differ (e.g., rate, duration).

Pros and Cons

- Pros: Removes cosigner regardless of original lender’s policy; potential for lower rates.

- Cons: Requires strong credit; may involve fees; new terms could extend repayment.

Historical Example: The Refinancing Boom

Refinancing gained traction after the 2008 recession, when interest rates dropped and online lenders like LendingClub emerged. By 2023, the student loan refinancing market was valued at $18 billion, per IBISWorld, with 1 in 5 borrowers refinancing to remove cosigners or lower rates. This shift shows how refinancing became a go-to for cosigner release when direct options fell short.

Insider Tip

Compare at least three lenders before refinancing. I spoke with a loan officer at a major credit union who shared that borrowers who shop around save an average of 1.2% on interest rates. Use tools like Credible to streamline the process. Compare loans with LendingTree.

Option 3: Pay Off the Loan Entirely

It sounds obvious, but paying off the loan in full is a guaranteed way to release a cosigner. Once the balance hits zero, the loan—and the cosigner’s obligation—disappears. However, this option isn’t always realistic unless you’ve got significant savings or a windfall.

Strategies to Pay Off Faster

- Extra payments: Add $50–$200 to monthly payments to chip away at principal.

- Lump-sum payment: Use a bonus, tax refund, or inheritance to clear the balance.

- Debt snowball/avalanche: Prioritize this loan if you’re tackling multiple debts.

Pros and Cons

- Pros: No eligibility hurdles; immediate cosigner release.

- Cons: Requires significant funds; may not be feasible for large loans.

Storytelling: Mark’s Early Payoff Victory

Mark, a 32-year-old teacher, owed $15,000 on a car loan cosigned by his sister. In 2021, he landed a side gig tutoring online, earning an extra $500 a month. Instead of splurging, he funneled every penny toward the loan, paying it off 18 months early. His sister, thrilled to be free of the obligation, threw him a celebratory dinner. Mark’s advice: “Even small extra payments add up—don’t underestimate them.”

Data Point

Per the Federal Reserve, 28% of borrowers who pay off loans early cite cosigner release as a motivator, especially for loans under $20,000.

Option 4: Negotiate with the Lender for Alternatives

In rare cases, lenders may agree to modify loan terms without a formal cosigner release. This could mean restructuring the loan or releasing the cosigner through a custom agreement. While uncommon, it’s worth exploring if other options fail.

How to Approach It

- Call the lender and explain your situation calmly.

- Present evidence of financial stability (e.g., payment history, income).

- Ask about any unpublished options or exceptions.

Pros and Cons

- Pros: Avoids refinancing or payoff; tailored solution.

- Cons: Low success rate; depends on lender flexibility.

Real-World Insight

I reached out to a former loan processor who worked at a regional bank. She revealed that while formal cosigner release programs are standard, some smaller lenders occasionally grant exceptions for long-term customers with flawless payment records. Her advice? Build rapport with the lender and be persistent but polite.

Step-by-Step Guide to Removing a Cosigner

Feeling ready to take action? Here’s a clear roadmap to navigate cosigner release options, whether you’re aiming for a direct release, refinancing, or another path.

1. Review Your Loan Agreement: Dig into the fine print to confirm if cosigner release is offered and what’s required.

2. Assess Your Eligibility: Check your credit score (use free tools like Credit Karma), payment history, and DTI ratio.

3. Gather Documentation: Collect pay stubs, tax returns, and bank statements to prove income stability.

4. Contact the Lender: Call or email to clarify the process and request any specific forms.

5. Apply for Release or Refinance: Submit your application, double-checking for errors.

5. Follow Up: Track the application status and respond promptly to additional requests.

6. Confirm Release: Ensure the cosigner is officially off the loan with written confirmation.

Pro Tip: Timing Matters

Apply for cosigner release during a strong financial period—like after a raise or when your credit score peaks. A 2024 TransUnion report noted (TransUnion’s credit report insights) that borrowers with credit scores above 720 are 85% more likely to qualify for release than those below 650.

What If Cosigner Release Isn’t an Option?

Sometimes, the stars don’t align. Maybe your lender doesn’t offer cosigner release, or your credit isn’t quite there yet. Don’t despair—there are still ways to move forward.

Build Your Financial Profile

- Boost your credit: Pay down credit card balances and avoid new debt.

- Increase income: Take on a side hustle or negotiate a raise.

- Reapply later: Many lenders let you try again after 6–12 months. Continue building credit and reapply later. Look for NerdWallet’s credit-building tips.

Communicate with Your Cosigner

Open dialogue is key. Explain your efforts to remove them and commit to timely payments in the meantime. A 2023 survey by LendingTree found that 45% of cosigners feel anxious about their role, but regular updates from borrowers reduce stress significantly.

Explore Refinancing Again

If you were denied refinancing, work on weak spots (e.g., credit score) and shop around with different lenders. Credit unions, for instance, often have more flexible terms than big banks.

Common Mistakes to Avoid When Pursuing Cosigner Release

Even with the best intentions, it’s easy to stumble. Here are pitfalls to sidestep:

- Missing payments: Even one late payment can disqualify you from release.

- Ignoring credit health: Applying with a low score wastes time and dings your credit further.

- Rushing refinancing: Accepting the first offer without comparing rates can cost thousands.

- Assuming verbal agreements count: Always get cosigner release in writing.

Story: Jenna’s Costly Oversight

Jenna, a 30-year-old nurse, assumed her lender would automatically release her mom as cosigner after two years of payments. She didn’t read the fine print and missed the application deadline, forcing her to refinance at a higher rate. “I wish I’d called the lender sooner,” she said. Her lesson? Don’t assume—verify.

The Bigger Picture: Why Cosigner Release Empowers Everyone

Pursuing cosigner release options isn’t just about paperwork—it’s about growth. For you, it’s a milestone in financial maturity. For your cosigner, it’s freedom from worry. And for your relationship, it’s a chance to move forward without the shadow of shared debt.

Consider this: a 2024 study by the National Bureau of Economic Research found that financial independence boosts mental health and relationship satisfaction for young adults. Releasing a cosigner can be a step toward that freedom, signaling to yourself and others that you’re ready to take charge.

A Fresh Perspective: Cosigner Release as Gratitude

Here’s a unique angle: think of cosigner release as a thank-you note to the person who believed in you. Instead of viewing it as a chore, approach it as a way to honor their trust. This mindset shifts the process from stressful to meaningful, making every step feel like progress.

FAQs About Cosigner Release

To wrap up, let’s tackle some common questions about how to remove a cosigner from a loan:

Does cosigner release affect my credit?

It might cause a small dip if the lender runs a hard inquiry, but timely payments on the loan afterward can offset this.

How long does the process take?

Direct release takes 2–8 weeks; refinancing can take 1–3 months, depending on the lender.

Can I remove a cosigner from a mortgage?

It’s tougher but possible through refinancing or, rarely, lender-approved release. Mortgages often require extensive documentation.

Conclusion: Take the First Step Today

Removing a cosigner from your loan might seem daunting, but it’s a journey worth taking. Whether you apply for a direct release, refinance, or pay off the loan, each cosigner release option brings you closer to financial freedom and strengthens your bond with the person who backed you. Start by checking your loan agreement or calling your lender—you’ll be surprised how empowering that first step feels.Have you tried releasing a cosigner before? Share your story in the comments or reach out for personalized advice. And if you found this guide helpful, explore our other posts on managing loans and building credit!

(For more information on No Cosigner Bootcamp Loans with Low Credit Scores Click Here.)