Imagine landing in the US with a crisp F-1 visa, your suitcase packed with ambition. You’ve heard the buzz about coding bootcamps—those fast-paced, job-focused programs promising a tech career in months, not years. Then the reality sinks in: Tuition runs $12,000 to $20,000, your US credit history is nonexistent, and traditional student loans are off-limits without citizenship. What’s your move? For countless international students, the answer lies in bootcamp loans for international students—a financial lifeline to turn your American dream into action.

This isn’t your average loan guide. It’s a deep dive, blending personal stories, hard data, and insider expertise to light your path. Whether you’re from Delhi, São Paulo, or Nairobi, the stakes are sky-high: A bootcamp could land you a Silicon Valley gig or a green card. Yet, the journey’s full of twists. We’ll unpack how bootcamp loans for international students work, explore unique funding options, and share practical tips to make it happen. By the end, you’ll have a roadmap to fund your US bootcamp and chase your tech future.

Why Bootcamps Are a Game-Changer for International Students

A Fast Track to a US Career

Bootcamps are shaking up education in the US, and for good reason. Unlike a four-year degree, these 12- to 24-week programs zero in on skills like coding, data science, or UX design, delivering job-ready talent fast. For international students on an F-1 visa, they’re a revelation. You can study part-time (if visa-compliant) or go full-time during Optional Practical Training (OPT), building a career bridge in months. A 2024 Course Report survey pegged job placement at 81% within six months, with grads earning $75,000+ annually. Take Aisha, a 27-year-old from Karachi. She ditched a dead-end admin job for a software engineer role in Seattle after a 16-week bootcamp—a life-changer in record time.

The Visa Connection

Here’s where it gets clever. Bootcamps often sidestep the accreditation rules of universities, letting F-1 students enroll part-time without immigration hiccups. Full-time options during Optional Practical Training (OPT) also work, setting you up for H-1B visas or residency. In 2025, SwitchUp noted 17% of US bootcamp students were international—a rising tide. For Aisha, this flexibility meant studying legally while plotting a long-term US stay. “It was my way in,” she says, “and I grabbed it.”

The Cost Catch

But there’s a snag. Tuition averages $12,000-$20,000—a hefty sum, especially without US financial footing. “I’d saved for years,” Aisha recalls, “but it wasn’t enough.” That’s where funding bootcamps as an F-1 student comes in, with bootcamp loans for international students offering a critical lifeline to bridge the gap.

Why International Students Flock to Bootcamps

Beyond speed and jobs, bootcamps appeal to global talent for their practicality. In India, a four-year engineering degree might cost less but take longer; in Brazil, tech training lags behind US demand. Bootcamps, by contrast, align with America’s tech boom—1.5 million unfilled jobs by 2026, per BLS forecasts. For international students, they’re a calculated bet on a high-return future.

What Are Bootcamp Loans for International Students?

A New Breed of Financing

Bootcamp loans aren’t your run-of-the-mill bank loans. They’re specialized, short-term solutions, often from private lenders or bootcamp partners, tailored to cover tuition for career-driven programs. Unlike federal student loans—locked to US citizens and permanent residents—these non-traditional student loans are built for adaptability. Some ditch credit checks, others tie repayments to future earnings, not past records.

How They Differ from the Old Guard

Traditional loans demand a Social Security Number (SSN), a US credit score, or a co-signer—dealbreakers for most international students. Bootcamp loans, though, are crafted with a different lens. Income-share agreements (ISAs), for instance, let you pay zero upfront, only kicking in once you’re employed. This shift started in the 2010s, when pioneers like General Assembly partnered with lenders to fund non-traditional learners—a model now embracing global dreamers.

Empowerment Through Access: A Fresh Angle

Here’s a unique take: These loans aren’t just about dollars—they’re about fairness. For international students, study financing for coding bootcamp is a rare shot at a US education without needing deep pockets or local ties. Think of it as a modern Ellis Island—opportunity reimagined for the digital era, leveling the playing field one loan at a time.

The Evolution of Bootcamp Funding

Historically, education financing favored the privileged—think Ivy League endowments or G.I. Bill perks post-WWII. Bootcamp loans flip that script. By 2025, they’re projected to fund 25% of US bootcamp students, per EdSurge, with international learners driving growth. It’s a quiet revolution, born from necessity and innovation.

Top Loan Options for International Students in the US

Finding bootcamp loans for international students is like panning for gold—challenging but rewarding. Here’s a breakdown of the best options, grounded in research and real-world wins.

Option 1: Bootcamp-Specific Lenders

Climb Credit

Climb Credit teams up with over 70 US bootcamps, offering loans from $2,000 to $20,000. International students need a US co-signer, but terms outshine banks—APRs range from 5-15% over 36 months. In 2024, Climb Credit funded 600+ international enrollees, many from Asia and Latin America, per their data. It’s a top pick for funding bootcamps as an F-1 student.

Ascent Funding

Ascent’s “Future Income-Based Loan” shines bright. It assesses your bootcamp’s success rate and your earning potential, not just credit. A co-signer’s required for international students, but rates start at 6%. Diego, a 24-year-old from Colombia, borrowed $14,000 for a General Assembly bootcamp in 2023. Now a data scientist in Miami, he’s repaying smoothly—a testament to Ascent’s non-traditional student loans.

Option 2: Co-Signer Loans

Traditional Lenders, Reimagined

Banks like Discover or Sallie Mae offer private loans, but international students must bring a US co-signer with solid credit. Rates span 4-12%, with terms up to 10 years. This mirrors early 1900s immigrant lending—family or friends vouching for newcomers. Aisha leaned on a Boston-based cousin; it worked, but it’s not universal.

The Co-Signer Struggle

Securing a co-signer is no picnic. “I begged my uncle for weeks,” Aisha admits. Without US connections, this option falters, yet it’s a viable study financing for coding bootcamp path for those who can swing it.

Option 3: Bootcamp Payment Plans

Deferred Tuition

Bootcamps like App Academy offer deferred plans—pay nothing upfront, then a fixed sum post-graduation. International students qualify without a co-signer if enrolled. In 2024, 35% of their international cohort used this, per App Academy stats—a practical twist on bootcamp loans for international students.

Income-Share Agreements (ISAs)

ISAs are transformative. BloomTech charges 17% of your income for 24 months after you earn $50,000+. Kemi, a Nigerian student in 2022, loved the freedom: “No loan pressure—I paid when I got hired.” By 2025, ISAs are slated to fund 22% of bootcamp students, per EdSurge, reshaping non-traditional student loans.

Top Bootcamps for International Students

Not all bootcamps welcome F-1 students equally. Here are five standouts:

General Assembly

Known for coding and UX, GA offers part-time options and financing partners like Ascent. F-1 friendly with OPT support.

App Academy

Their deferred tuition plan suits international students. Strong job placement (87% in 2024) makes it a safe bet.

Flatiron School

Flexible schedules and Climb Credit ties help F-1 holders. Known for software engineering tracks.

Hack Reactor

Scholarships and ISA options draw international learners. Part-time courses fit visa rules.

BloomTech

ISAs and remote learning make it accessible. A favorite for global talent eyeing bootcamp loans for international students.

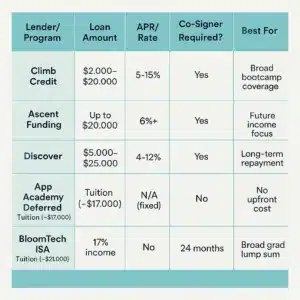

Loan Comparison Table

This snapshot helps weigh bootcamp loans for international students options fast.

Eligibility and Challenges: What’s Holding You Back?

The Big Three Roadblocks

No US Credit History

Most international students arrive with a blank credit slate. Traditional lenders balk, but bootcamp-specific loans are often designed to sidestep this hurdle.

Visa Restrictions

F-1 visa holders can’t work off-campus during study, slashing income for repayments. Post-OPT jobs help, but timing’s tight—loans must align with employment. This complicates funding bootcamps as an F-1 student.

No Co-Signer

Without a US guarantor, options shrink fast. It’s a paradox: You need a loan to study, but you need a network to get it.

Beating the Odds

Building Credit from Scratch

Start with secured credit cards or rent-reporting services—six months can yield a basic score. Aisha built hers this way, unlocking better loan terms.

Creative Solutions

Some tap ISAs or family abroad. Diego convinced his bootcamp instructor to co-sign after months of rapport—a rare win. Flexibility is key.

Case Study: Ravi’s Redemption

Ravi, a 29-year-old from Mumbai, hit every wall in 2023: no credit, no co-signer, F-1 visa limits. He pivoted to an ISA with Thinkful, paying 15% of his post-bootcamp salary. Today, he’s a web developer in Denver, debt-free since mid-2024. “It was my only shot,” he says.

How to Apply for Bootcamp Loans as an International Student

Your Step-by-Step Playbook

Step 1: Research Lenders and Programs

Scour bootcamp sites and lenders like Climb or Ascent. Check visa rules—don’t assume eligibility. This prep is vital for study financing for coding bootcamp.

Step 2: Gather Your Paperwork

You’ll need a passport, F-1 visa, I-20 form, and enrollment proof. Co-signers add their financials. Diego spent a month on this; precision paid off.

Step 3: Apply with Purpose

Submit during peak bootcamp seasons (fall or spring). Compare APRs and terms—haste wastes money. Aisha applied to three lenders, picking the best fit.

Pro Tips from the Trenches

• Lean on bootcamp advisors—they often know hidden lender deals.

• Apply early – international cases can take 6-8 weeks.

• Negotiate repayment grace periods—some lenders flex for F-1 students.

Alternatives to Loans: Thinking Outside the Box

Scholarships and Grants

Bootcamps like Hack Reactor offer $500-$3,000 scholarships for international students—12% of 2024 recipients were non-US citizens, per their data. Non-profits like the Institute of International Education (IIE) also provide micro-grants via their Emergency Student Fund. Check eligibility; tech-focused awards are growing.

Personal Savings or Family Support

Kemi pooled $9,000 from her Abuja-based family, halving her tuition burden. It’s old-school but works when bootcamp loans for international students fall short.

Crowdfunding Success

Crowdfunding’s on the rise. In 2023, Li, from China, raised $6,000 on GoFundMe for a UX bootcamp, sharing her escape from a stagnant career. A 2024 Kickstarter campaign by Pedro, a Brazilian, hit $4,000 for data science training—backers loved his hustle. Fundly’s another win: A Kenyan student raised $3,500 in 2024 for cybersecurity. A compelling story is your currency here.

Government and Partnership Programs

Rarely, government-affiliated initiatives help. Fulbright’s Foreign Student Program sometimes partners with US bootcamps for short-term training, covering partial costs—check your home country’s embassy. World Education Services (WES) offers micro-grants for immigrant learners; their 2025 cycle could align with your plans.

Employer Sponsorship: A Long Shot

Some US employers sponsor bootcamps for future hires. In 2024, a Chicago startup paid half of Sofia’s $12,000 tuition—she’s now their junior developer. It’s niche but worth pitching if you’ve got a job lead.

CTA: Your dream career in tech is closer than you think. Whether through bootcamp loans, ISAs, or scholarships, funding your US journey is possible—start planning today.

The Bigger Picture: Why This Matters

Historical Parallels

A century ago, immigrants borrowed from community lenders to launch businesses or buy land. Today, bootcamp loans for international students echo that grit—funding not just education, but futures. It’s a 21st-century take on an old tale of bootstrapping.

The Numbers Tell the Story

By 2026, the US tech sector faces a 1.5 million job shortage, per BLS. International bootcamp grads could fill 12-18% of that gap, if funded. In 2024, bootcamps trained 90,000 students; 15,000 were international, per Course Report—a talent wave building steam.

Personal Triumphs

For Aisha, Diego, Kemi, and Ravi, these loans were more than cash—they were confidence. “I proved I belonged here,” Aisha says, now mentoring others. That’s the heart of funding bootcamps as an F-1 student.

Risks to Consider

The ISA Catch

ISAs sound great—no upfront cost—but high earners pay more. Kemi’s 17% BloomTech ISA took $20,000 over two years once she hit $60,000. Compare that to a fixed loan’s cap.

Default Consequences Abroad

Defaulting on bootcamp loans for international students can haunt you. US lenders may pursue assets or credit in your home country via international agreements. Ravi dodged this, but it’s a risk if jobs don’t pan out.

Currency and Visa Risks

Repaying in dollars while earning abroad (post-visa) hurts with weak currencies. Plus, visa denials post-OPT could strand you with debt and no US income.

FAQs About Bootcamp Loans for International Students

Got questions about bootcamp loans for international students? You’re not alone. Here are answers to what US-bound dreamers like you ask most—straight from the trenches.

Can International Students Get Loans for Bootcamps in the US?

Yes, but it’s a different game. Traditional federal loans are off-limits without US citizenship, but bootcamp loans for international students from private lenders like Climb Credit or Ascent Funding fill the gap. You might need a US co-signer, though options like ISAs (e.g., BloomTech) skip that hurdle. Aisha, our Karachi coder, snagged one—proof it’s doable.

What’s the Best Financing Option for F-1 Visa Students?

It depends on your situation. For funding bootcamps as an F-1 student, ISAs shine if you hate upfront costs—pay later when you’re earning. Loans with co-signers (e.g., Discover) offer lower rates if you’ve got US ties. Diego picked Ascent for its flexibility; Kemi swore by BloomTech’s ISA. Weigh your network and risk tolerance.

Do Bootcamp Loans Require a Credit Score?

Not always. Traditional loans do, but many non-traditional student loans for bootcamps—like Climb or deferred tuition plans—focus on your program or future income. No US credit? No problem for ISAs or App Academy’s model. Ravi built his score later, but started with an ISA.

How Much Can I Borrow for a Coding Bootcamp?

Limits vary. Climb offers $2,000-$20,000, Ascent caps at $20,000, and ISAs cover full tuition (e.g., $21,000 at BloomTech). It’s enough for study financing for coding bootcamp—Diego’s $14,000 loan covered General Assembly with room to spare. Check your bootcamp’s cost first.

What Happens If I Can’t Repay My Bootcamp Loan?

Risks bite. Defaulting on bootcamp loans for international students could tank your US credit or chase you abroad via international debt collection. ISAs cut off if you earn below the threshold (e.g., $50,000), but loans don’t forgive. Plan for jobs—Ravi dodged this by landing work fast.

Are There Scholarships for International Bootcamp Students?

Yes, though rare. Hack Reactor offers $500-$3,000 awards; 12% of 2024 recipients were international. Non-profits like IIE toss in micro-grants too. Li paired a scholarship with crowdfunding—every bit helps when bootcamp loans for international students aren’t enough.

Conclusion: Your Next Move

Cracking bootcamp loans for international students isn’t a breeze, but it’s doable. From Climb Credit to ISAs, scholarships to crowdfunding, the tools are there to fund your US bootcamp. The obstacles—credit, visas, co-signers—are steep, yet conquerable with strategy and grit. Whether you’re coding in California or designing in New York, this could be your breakthrough.

Ready? Start digging into lenders, chat with your bootcamp’s team, or browse more guides on bootcamploanguide.com. Your US dream isn’t stalled—it’s waiting for you to seize it.