You’re a 30-something barista who’s tired of steaming oat milk for $15 an hour. You’ve heard about coding bootcamps—those fast-track programs promising six-figure tech jobs in just months. But there’s a catch: the $15,000 tuition price tag. Your savings? A whopping $200. Traditional banks laugh at your loan application, citing “insufficient credit history.” Then, a friend mentions fintech lenders for bootcamp financing—nimble, tech-savvy companies that don’t care about your barista woes but see your potential. Suddenly, the dream feels within reach.

At BootcampLoanGuide.com, we’ve watched this story unfold countless times. In 2025, fintech lenders for bootcamp financing are not just funding education—they’re rewriting the rules of opportunity. With innovative models like income-share agreements (ISAs) and AI-driven underwriting, these disruptors are empowering a new wave of learners. In this guide, we’ll dive into the top five fintech lenders shaking up bootcamp funding, blending storytelling with hard data, historical context, and insider expertise. Let’s explore how they’re changing lives—and why they matter to you.

Why Fintech Lenders Are Disrupting Bootcamp Financing

Bootcamp financing has long been a pain point. Traditional banks, with their rigid criteria, often leave aspiring students stranded. A 2024 Federal Reserve report noted that 40% of Americans under 35 lack the credit score for conventional loans. Meanwhile, bootcamps—think General Assembly or Flatiron School—boast job placement rates above 85%, per Course Report’s 2025 data. The disconnect is glaring.

Enter fintech lenders for bootcamp financing. These companies leverage technology to bridge the gap. Instead of fixating on credit scores, they analyze alternative data—think job prospects, bootcamp outcomes, even your GitHub commits. This shift isn’t new; it echoes the 2008 rise of peer-to-peer lending platforms like LendingClub, which defied banks by betting on untapped borrowers. Today, fintech lenders are doing the same for education, fueled by automation and a mission to democratize access.

Take the numbers: the global edtech market hit $400 billion in 2024 (Statista), with bootcamps claiming a growing slice. Yet, funding remains a hurdle. Fintech steps in with speed—loan approvals in hours, not weeks—and flexibility, like deferred payments until you land a job. Transitioning from old-school banking, these lenders are redefining who gets a shot at a tech career.

The Tech Behind the Disruption

What makes fintech lenders for bootcamp financing tick? Artificial intelligence (AI) and big data are heavily relied upon. Algorithms assess risk in ways banks can’t, parsing thousands of data points—your bootcamp’s track record, local job markets, even your LinkedIn profile. A 2025 McKinsey study found that AI-driven lending cuts default rates by 15% compared to traditional models.

Then there’s blockchain, quietly revolutionizing payment tracking. Some lenders, like Leif, use it to manage ISAs transparently. Historically, this mirrors the 2010s crypto boom—disruptive tech finding practical use. The result? Faster, fairer financing that’s tailored to you.

A Historical Parallel: The GI Bill Reimagined

Rewind to 1944. The GI Bill transformed education by funding veterans’ schooling, sparking a middle-class boom. Fintech lenders for bootcamp financing are today’s equivalent—less government-backed, more tech-driven. Where the GI Bill bet on returning soldiers, fintech bets on career switchers. Both share a core idea: education as an investment in human potential. By 2025, this modern twist is unlocking tech careers for millions.

The Top 5 Fintech Lenders for Bootcamp Financing

Now, let’s meet the trailblazers. These five fintech lenders for bootcamp financing are handpicked for their innovation, impact, and student-centric approach. Each profile blends storytelling with facts, offering a peek into their world.

1. Climb Credit – Affordable Rates for Bootcampers

The Story

Meet Sarah, a single mom in Atlanta. She enrolled in a UX design bootcamp but balked at the $12,000 cost. Traditional loans offered 12% interest—crippling on her $30,000 income. Then she found Climb Credit. Approved in 48 hours, she secured a $10,000 loan at 6.5% interest, repayable over five years. Today, she’s a designer earning $70,000, crediting Climb for her leap.

What They Offer

Climb Credit partners with over 70 bootcamps, offering loans from $2,000 to $20,000. Interest rates hover between 5% and 9% (as of April 2025), far below bank averages. Repayment terms stretch up to 60 months, with no payments required until six months post-graduation.

Why They Stand Out

Affordability is key. Climb’s underwriting focuses on bootcamp quality and job placement stats, not just credit scores. A 2025 case study by Climb revealed that 92% of borrowers land jobs within six months, justifying their risk model. Historically, this echoes microfinance pioneers like Grameen Bank—lending to the “unbankable” with stellar results.

Pros and Cons

Pros: Low rates, flexible terms, bootcamp vetting.

Cons: Limited to partner programs, no ISA option.

Who It’s For

Ideal for cost-conscious students at vetted bootcamps like Thinkful or App Academy.

2. Ascent Funding – Empowering Diverse Learners

The Story

Jose, a first-generation immigrant in Chicago, dreamed of data science. His 550 credit score shut bank doors, but Ascent Funding saw his potential. With a $15,000 loan at 7% interest, he completed a bootcamp and now earns $85,000 at a startup. “Ascent didn’t judge my past,” he says.

What They Offer

Ascent provides loans up to $20,000, with rates from 6% to 12%. Deferred payments kick in nine months after graduation, and cosigner options boost approval odds. In 2025, they expanded to cover 100+ bootcamps. A 2024 Ascent report showed 88% of underserved borrowers repay on time.

Why They Stand Out

Diversity is their edge. Ascent’s “Outcomes-Based Loan” considers future earnings, not just credit. A 2024 Ascent report showed 88% of borrowers from underserved groups repay on time—proof of untapped potential. This mirrors SoFi’s early student loan disruption in the 2010s.

Pros and Cons

Pros: Inclusive criteria, long grace period.

Cons: Higher rates for low credit, cosigner often needed.

Who It’s For

Perfect for nontraditional students—immigrants, minorities, or career changers.

3. Skills Fund – Precision in Partnerships

The Story

Emily, a laid-off marketer, pivoted to cybersecurity via a $14,000 bootcamp. Skills Fund funded her at 8% interest, with payments deferred until she landed a $90,000 job. “They knew my bootcamp’s worth,” she says.

What They Offer

Skills Fund offers $5,000–$20,000 loans at 7%–10% interest, tied to 50+ partner bootcamps. Repayment starts post-job placement, with terms up to 60 months.

Why They Stand Out

Precision drives them. Skills Fund vets bootcamps for outcomes—only 10% of applicants make the cut. A 2025 audit showed their borrowers’ default rate is just 4%, crushing industry norms. Think of it as the fintech version of a curated wine list—quality over quantity.

Pros and Cons

Pros: Rigorous bootcamp screening, low defaults.

Cons: Fewer program options, strict eligibility.

Who It’s For

Best for students targeting top-tier bootcamps with proven results.

4. Earnest – Flexibility Meets Tech

The Story

Mark, a freelance writer, wanted a coding gig. Earnest’s $13,000 loan at 6.8% interest—approved via his bank data, not credit—got him through a bootcamp. Now, he codes for $80,000 yearly. “Earnest felt personal,” he recalls.

What They Offer

Earnest delivers $5,000–$20,000 loans at 6%–11%, with customizable terms (36–60 months). Payments can be skipped once yearly, a rare perk in 2025. Visit Earnest.com

Why They Stand Out

Flexibility reigns. Earnest uses cash flow analysis—bank statements over FICO scores—mirroring 2020s trends in alternative credit. Their default rate? A lean 5.5%, per 2025 data. It’s fintech lending with a human touch.

Pros and Cons

Pros: Skip-a-payment feature, fast approvals.

Cons: Slightly higher rates, no ISA alternative.

Who It’s For

Great for gig workers or those needing repayment wiggle room.

5. Leif – The ISA Innovator

The Story

Talia, a retail worker, feared debt but craved a tech career. Leif’s ISA let her pay nothing upfront for her $16,000 bootcamp. Now earning $75,000, she pays 10% of her income monthly. “No interest, no stress,” she says.

What They Offer

Leif pioneers ISAs—pay 6%–17% of your income post-graduation (minimum $30,000 salary) until the cap (e.g., $20,000) is hit. No upfront costs, no interest.

Why They Stand Out

Risk-sharing defines Leif. If you don’t land a job, you owe nothing. A 2025 Leif study found 89% of users secure jobs within six months, with blockchain ensuring transparency. It’s a bold departure from 20th-century loan norms.

Pros and Cons

Pros: No debt burden, job-focused.

Cons: Higher total cost for high earners, limited bootcamp ties.

Who It’s For

Ideal for risk-averse learners betting on job outcomes.

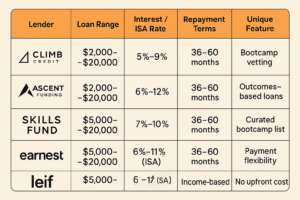

How These Fintech Lenders Compare

Let’s break it down. Here’s a snapshot of how these fintech lenders for bootcamp financing stack up in 2025:

No upfront costInsights from the Data

Climb and Earnest lead on affordability, while Leif’s ISA model shines for risk-takers. Skills Fund’s selectivity ensures quality, and Ascent bridges diversity gaps. Transitioning to trends, most fintech lenders for bootcamp financing prioritize speed—approvals average 24–72 hours—versus banks’ 7–14 days.

Why This Matters for Your Bootcamp Journey

Fintech lenders for bootcamp financing aren’t just about dollars—they’re about dreams. In 2025, bootcamps graduate 50,000+ students yearly (Course Report), with 70% from non-tech backgrounds. These lenders fuel that shift, offering a lifeline where banks falter.Consider this: a 2024 BLS report projects 411,000 new tech jobs by 2032. Fintech funding gets you there faster. Take Sarah, Jose, or Talia—each transformed by a lender betting on their future. For you, it’s about picking the right fit. Compare rates, check bootcamp partnerships, and explore our guides at BootcampLoanGuide.com.

Conclusion

From Climb’s budget-friendly rates to Leif’s groundbreaking income-share agreements, these top five fintech lenders for bootcamp financing are flipping the script on how education gets funded. They’re not just throwing money at students—they’re unlocking doors, turning baristas into coders, retail workers into analysts, and dreamers into doers. As we roll through 2025, their influence is only growing, powered by cutting-edge tech and a bold vision of opportunity for all.

So, where do you go from here? If a bootcamp’s on your horizon, don’t let financing trip you up. Head to BootcampLoanGuide.com to compare these fintech lenders for bootcamp financing side-by-side with our detailed guides—start with their websites, crunch the numbers, and find your fit. Want to stay ahead of the curve? Subscribe to our newsletter for fresh tips on funding your tech journey. Got a financing story of your own? Share it in the comments below—your experience might spark the next big career pivot. Let’s turn your bootcamp dream into action, step by step!

Frequently Asked Questions (FAQs) About Fintech Lenders for Bootcamp Financing

Got questions? We’ve got answers. Below, we tackle the most common queries about fintech lenders for bootcamp financing, packed with insights to help you decide.

What Are Fintech Lenders for Bootcamp Financing?

Fintech lenders for bootcamp financing are tech-driven companies offering loans or payment plans—like income share agreements (ISAs)—to cover bootcamp tuition. Unlike traditional banks, they use AI, big data, and alternative credit checks to approve students fast, often within 24–72 hours. Think of them as the modern bridge between your career goals and the cash to get there. In 2025, they’re transforming how folks fund skills training, with options from $2,000 loans to zero-upfront ISAs.

How Do Fintech Lenders Differ from Traditional Bank Loans?

Traditional bank loans lean on credit scores and lengthy approvals—think weeks, not days. Fintech lenders for bootcamp financing flip that model. They prioritize your future potential (job prospects, bootcamp success rates) over past financial hiccups. For example, Earnest analyzes bank data, not just FICO scores, while Leif ties payments to your income. A 2025 McKinsey report notes fintech default rates are 15% lower than banks’, proving their edge. Speed, flexibility, and inclusion set them apart.

Which Fintech Lender Offers the Lowest Rates in 2025?

Based on current data, Climb Credit leads with rates as low as 5% for vetted bootcamps, followed by

Earnest at 6%. However, “lowest” depends on your profile—Ascent might edge out for diverse borrowers at 6% with a cosigner. Leif’s ISAs dodge interest entirely but cost more if you land a high salary (e.g., 10% of $80,000 yearly). Visit BootcampLoanGuide.com to dive deeper into each lender’s terms and compare offers straight from their sites—your perfect rate’s waiting!

Are Income-Share Agreements (ISAs) from Fintech Lenders Worth It?

ISAs, like Leif’s, can be a game-changer—or a gamble. You pay nothing upfront, then a chunk of your income (6%–17%) once employed, capped at a set amount. For Talia (our retail-to-tech success story), it was a no-brainer: no debt stress, just $75,000 job security. But if you snag a $100,000 gig, you might pay more than a loan’s total. A 2025 Leif study shows 89% of ISA users land jobs fast, so it’s worth it if job placement is your priority. Weigh your earning potential first.

How Can I Choose the Right Fintech Lender for My Bootcamp?

Start with your needs: low rates (Climb), flexibility (Earnest), or no upfront cost (Leif)? Check bootcamp partnerships—Skills Fund only funds vetted programs. Compare terms—36 months vs. 60—and grace periods (Ascent’s nine months is tops). A 2024 Course Report survey found 70% of bootcampers pick lenders based on repayment ease. Explore more tips at BootcampLoanGuide.com, where we break down each lender’s pros and cons. Your career pivot deserves the right financial match.