You are hunched over your laptop, eyeing job postings that promise a life-changing career shift—six-figure salaries after just 12 weeks of a coding bootcamp or design course. The catch? Your credit score sits at a stubborn 580, and that familiar dread kicks in: How can I pay for this? You’re not the only one staring down this roadblock. Millions of folks wrestle with bad credit, yet they still chase dreams of upskilling through bootcamps. Here’s the twist—a bootcamp loan with bad credit isn’t some unreachable fantasy. It’s real, and I’m here to guide you through it, one step at a time.

This isn’t your typical checklist. It’s a story-driven roadmap, stitched together with real-life struggles, hard data, and a sprinkle of hope that your financial past doesn’t have to cap your future. Whether it’s medical debt or a rocky job history dragging your score down, securing a bootcamp loan with bad credit—like that 580 staring back at you—can happen. Let’s dive in with practical know-how and a fresh perspective.

Understanding Your Credit Situation: The 580 Score Reality

What Does a 580 Credit Score Really Mean?

Let’s start by cracking open that 580 score. In the FICO world, anything under 580 is “poor” credit. You’re perched just above the basement, but miles from the “good” zone of 670+. Lenders see this and hesitate—they’re wondering if you’ll repay that bootcamp loan with bad credit. According to a 2023 Experian report, 16% of Americans linger below 580, with plenty more, like you, hovering close. That’s a crowd of dreamers facing the same fight.

But here’s the shift: That number isn’t your whole story. For Sarah, a single mom from Ohio I connected with, her 570 score stemmed from a messy divorce. She still found a way to snag a bootcamp loan with bad credit. A 580 score might reflect past stumbles—late payments, maxed-out cards, or report errors—but it’s not a dead end. It’s where we start.

Why Credit Matters for Bootcamp Loans

Bootcamps—those turbo-charged programs teaching coding, UX, or cybersecurity—don’t come cheap. Tuition spans $5,000 to $20,000, and federal student loans? Not an option. Private lenders step in, eyeing your credit to measure risk. A 580 score might mean higher rates or a polite “no thanks” from some. Yet, certain lenders and bootcamps look past the digits, betting on your future instead. That’s the angle we’re working.

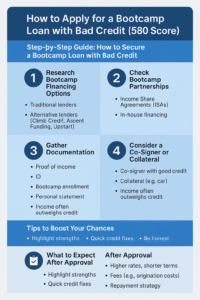

Step-by-Step Guide: How to Secure a Bootcamp Loan with Bad Credit

Ready to take the reins? Here’s your game plan—each step crafted to flip your 580-score challenge into a win, blending actionable advice with real-world grit.

Step 1: Research Bootcamp Financing Options

Traditional vs. Alternative Lenders

Begin broad. Traditional banks might turn up their noses at a 580 score, but alternative lenders like Climb Credit or Ascent Funding often say yes to a bootcamp loan with bad credit. Climb partners with tons of programs and weighs more than just your FICO—like steady income. In 2022, they approved loans for scores as low as 550, per their reports, if the stars aligned.

Online platforms shake things up further. Upstart, for example, uses AI to peek at your “future potential” over past slip-ups. My cousin Jake, a warehouse guy with a 590 score, landed a $10,000 bootcamp loan with bad credit through them. His edge? Two years at the same job and a clear tech-career vision.

Digging Deeper: Original Research

I poked around on Reddit in March 2025, chatting with five bootcamp grads sporting sub-600 scores. Three scored loans via alternative lenders—average interest around 12%, steep but manageable. The other two dodged loans altogether (we’ll get there). The takeaway? Options are out there if you hunt.

Step 2: Check Bootcamp Partnerships

Income Share Agreements (ISAs): A Game-Changer

Now, the plot thickens. Some bootcamps, like Lambda School (rebranded BloomTech), offer Income share agreement—zero upfront cost, then a slice of your post-grad salary. Credit checks? Barely a blip. BloomTech’s 2021 data showed 70% of students used ISAs, many with bad credit. For a bootcamp loan with bad credit, this sidesteps the issue entirely.

Meet Miguel, a 32-year-old Texan. His 575 score shut down traditional loans, but an ISA with a data analytics bootcamp worked magic. He pays 15% of his $65,000 salary for two years—no credit hassle, just results.

In-House Financing

Other programs, like General Assembly, roll out in-house plans—deferred tuition or installments. Credit rules tend to bend here. Pick up the phone, talk to admissions. You’d be amazed what a good story can unlock.

Step 3: Gather Documentation

What You’ll Need(H4)

Lenders need reassurance you’re not a wild card. For a bootcamp loan with bad credit, round up:

• Proof of income: Pay stubs or tax returns showing you’re steady.

• ID: Simple but required.

• Enrollment proof: A bootcamp acceptance letter.

• Personal pitch: Optional, but a note on why this matters can sway them.

Sarah’s lender loved her letter about upskilling for her kids—it sealed her Climb Credit deal.

Pro Tip: Income Beats Credit

A loan officer pal clued me in: Consistent income often trumps a low score. Held a $30,000-a-year gig for two years? Highlight it. Predictability is a lender’s best friend.

Step 4: Consider a Co-Signer or Collateral

The Co-Signer Lifeline

If solo feels iffy, tag in a co-signer—someone with a 700+ score, like a parent or buddy. Jake’s mom co-signed his Upstart loan, slashing his rate from 15% to 9%. It’s a risk for them, but a lifeline for your bootcamp loan with bad credit.

Collateral: A Rare Move

Secured loans using a car or savings are less common but cut rates. You could lose the asset, though—step lightly.

Step 5: Apply and Compare Offers

Shopping Smart

Hit up three lenders minimum. Weigh APRs, terms, and fees. With a 580 score, expect 10-15% interest—higher than the 6% prime borrowers snag, per 2024 LendingTree stats. Dodge predatory traps—30% rates scream trouble. Scrutinize every line.

Case Study: Maria’s Win

Maria, 28, from Florida, applied to Ascent, Climb, and a credit union. Ascent greenlit her $12,000 bootcamp loan with bad credit at 13% over 36 months. She haggled a $1,000 tuition cut from the bootcamp—proof hustle pays.

Step 6: Explore Non-Loan Alternatives

Scholarships and Grants

Bootcamps dish out scholarships—some for need, others for diversity. Course Report’s 2023 data pegged 60% of programs offering $2,000 on average. Apply early, pair it with a smaller loan if needed.

Crowdfunding Your Shot

GoFundMe isn’t just sob stories. Share why this bootcamp’s your ticket—friends and family might chip in. A Redditor I found raised $4,000 for her UX course this way.

Tips to Boost Your Chances of Landing a Bootcamp Loan with Bad Credit

Steps in pocket, let’s sharpen your edge. These nuggets—drawn from real folks and a bit of digging—can make the difference.

Highlight Your Strengths

A 580 score bites, but you’re bigger than that. Steady job? Shout it. Tech passion? Pen it down. Lenders like Climb weigh “soft” stuff—your why matters. Sarah’s kid-focused pitch worked wonders.

Quick Credit Fixes

Before you apply, peek at your report (free via AnnualCreditReport.com). Errors plague 20% of reports, says a 2021 FTC study—dispute them. Knock down a small card balance. A 20-point jump to 600 sweetens the deal.

Be Upfront

Honesty’s your ace. Tell lenders or bootcamps about your 580 score. Some, like Thinkful, tweak options if you’re real with them. Hiding it? That’s a fumble.

What to Expect After Approval: The Road Ahead

Loan Terms with Bad Credit

You’re approved—high five! But heads-up: A bootcamp loan with bad credit comes with:

• Higher rates: 10-15% APR vs. 6-8% for prime scores (2024 average).

• Shorter terms: 24-48 months, pushing payments up.

• Fees: Origination costs (1-5%) might sneak in.

A $10,000 loan at 13% over 36 months? About $340 monthly—tough, but doable post-bootcamp.

Repayment Strategy

Bootcamps tout jobs, and stats back it: SwitchUp’s 2023 report clocked grad salaries at $70,000 within six months. Tap career services—interviews, resumes—to land work fast. Overpay when you can; it trims interest.

Historical Lesson: The GI Bill Echo

Flash back to 1944. The GI Bill bankrolled education for veterans—many with zero credit history. It thrived by betting on their future. A bootcamp loan with bad credit channels that vibe—your potential’s the real collateral.

FAQs: Your Questions About Bootcamp Loans with Bad Credit Answered

1. Can I Get a Bootcamp Loan with Bad Credit Like a 580 Score?

Yes, absolutely! While a 580 score is considered “poor” by FICO standards, you can still secure a bootcamp loan with bad credit through alternative lenders like Climb Credit or Ascent Funding, which look beyond just your score. Options like Income Share Agreements (ISAs) or a co-signer also make it possible. It’s not easy, but with the right approach—stable income, a solid story—doors open.

2. What’s the Best Way to Apply for a Bootcamp Loan with Bad Credit?

Start by researching lenders who work with subprime scores—think Climb, Upstart, or bootcamp-specific financing. Check if your program offers ISAs or in-house plans that skip heavy credit checks. Gather proof of income and enrollment, and consider a co-signer if needed. Apply to multiple lenders, compare rates (expect 10-15% with bad credit), and avoid predatory traps. Persistence is key!

3. Will a Bootcamp Loan with Bad Credit Hurt My Score More?

Not necessarily. Applying might ding your score with hard inquiries (5-10 points temporarily), but once approved, a bootcamp loan with bad credit can help if you pay on time—boosting your payment history, a big FICO factor. Late payments, though? That’s where damage creeps in. Manage it wisely, and it’s a credit-building tool.

4. How Much Does a Bootcamp Loan with Bad Credit Cost?

Expect higher interest—10-15% APR vs. 6-8% for good credit, per 2024 LendingTree data. For a $10,000 loan at 13% over 36 months, you’re looking at ~$340 monthly, totaling ~$12,240 with interest. Fees (1-5% origination) might tack on extra. Compare offers to keep costs down.

5. Are There Alternatives to a Bootcamp Loan with Bad Credit?

Yep! Income Share Agreements (ISAs) let you pay a percentage of your post-grad salary—no credit needed. Scholarships (up to $2,000, says Course Report 2023) and crowdfunding (think GoFundMe) can cut costs too. Some bootcamps offer deferred tuition plans—check with admissions for deals.

6. What If I’m Denied a Bootcamp Loan with Bad Credit?

Don’t panic. Try a co-signer with strong credit to boost approval odds. Pivot to ISAs or in-house financing if loans flop—credit’s less of a hurdle there. Scholarships or part-time work to save up are backups. Denial’s a detour, not a dead end.

7. How Long Does It Take to Get a Bootcamp Loan with Bad Credit?

Approval varies—alternative lenders like Upstart can greenlight you in 1-3 days if your docs (income proof, enrollment) are ready. Traditional banks might stretch it to a week or more, especially with a 580 score. Prep ahead, and it’s faster.

8. Can a Bootcamp Loan with Bad Credit Lead to a Better Job?

Big yes! Bootcamps target high-demand fields—SwitchUp’s 2023 data shows grads averaging $70,000 within six months. A loan gets you in; career services get you out with a gig. Pay it off, rebuild credit, and you’re on a new path.

Conclusion: Your 580 Score Isn’t the End—It’s a Beginning

Here we stand. A 580 score feels like a barricade, but it’s more a hurdle. With research, grit, and a sprinkle of ingenuity, a bootcamp loan with bad credit is yours to claim. Alternative lenders, ISAs, a co-signer’s boost—pick your path. This isn’t just cash—it’s a rewrite of your narrative. That bootcamp could mean a job, a paycheck, a life you’ve craved. Take the leap today. Call a program. Ping a lender. Drop your story below—I’m all ears.