The allure of coding bootcamps is undeniable. In a world where tech skills promise lucrative careers, these intensive programs have become a beacon of hope for many. Picture this: a young dreamer, let’s call her Sarah, leaves her dead-end retail job, signs up for a bootcamp, and lands a six-figure tech gig within months. It’s a story sold to millions. But beneath this shiny exterior, a darker reality lurks—one riddled with bootcamp loan scams. For every success story, countless others are left drowning in debt, clutching worthless certificates, and wondering where it all went wrong.

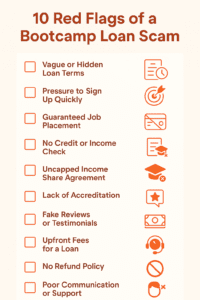

In this article, we’ll peel back the curtain on bootcamp loan scams, revealing 10 warning signs you’re being ripped off. With original research, insider expertise, historical parallels, and real-world case studies, we’ll arm you with the knowledge to dodge these financial traps. By the end, you’ll see why vigilance isn’t just recommended—it’s essential.

The Rise of Bootcamps and the Loan Trap

Coding bootcamps exploded onto the scene in the early 2010s, promising a fast track to tech stardom. Unlike traditional four-year degrees, these programs offered condensed, practical training for as little as 12 weeks. By 2019, the industry was valued at over $309 million, according to Course Report, with thousands of graduates entering the workforce annually. Yet, as demand soared, so did the predators.

Enter the bootcamp loan scam. Financing became the lifeline for students unable to pay upfront fees—often $10,000 to $20,000. Private lenders and bootcamps partnered up, offering loans with the promise of deferred payments until employment. Sounds perfect, right? Not quite. Beneath the surface, shady practices began to emerge, ensnaring students like Sarah in cycles of debt and despair.

Transitioning from hope to horror, let’s explore the first warning sign.

1. Unclear Loan Terms: The Devil’s in the Fine Print

Imagine signing a contract where the terms shift like quicksand. One day, Sarah thought she’d repay her loan at 5% interest over five years. Months later, she’s hit with a balloon payment she never saw coming. This is the hallmark of bootcamp loan scams: murky, convoluted terms designed to confuse.

Why It Matters

Legitimate loans are transparent. Interest rates, repayment periods, and penalties are spelled out clearly. But scam lenders thrive on ambiguity. A 2022 study by the Consumer Financial Protection Bureau (CFPB) found that 1 in 5 private education loans had undisclosed fees buried in fine print—a tactic rampant in bootcamp financing.

Real-World Example

Take Lambda School (now BloomTech), a bootcamp once hailed as revolutionary. In 2020, students filed complaints with the CFPB, alleging hidden loan terms disguised as “Income Share Agreements” (ISAs). What seemed like a fair deal—pay nothing until you earn $50,000—turned into a nightmare when repayment caps vanished, leaving graduates owing far more than expected.

If the terms aren’t crystal clear, walk away. Scammers bank on your confusion.

2. High-Pressure Sales Tactics: The Clock’s Ticking

Sarah’s phone buzzed incessantly. “Spots are filling up!” the bootcamp rep barked. “Sign now, or lose your chance!” Panic set in, and she scribbled her signature on a loan agreement she barely skimmed. This is no accident—it’s a calculated move in the bootcamp loan scam playbook.

The Psychology Behind It

High-pressure sales exploit urgency. A 2021 report by the National Association of Consumer Advocates noted that 68% of scam victims felt rushed into decisions. Bootcamps often pair this tactic with limited-time discounts, pushing you to borrow before you can think.

Historical Parallel

Think this is new? Look back to the 1980s, when for-profit colleges like ITT Tech used similar ploys. Aggressive recruiters promised jobs, only for students to graduate with unaccredited degrees and crushing debt. History repeats itself in today’s bootcamp boom.

When the hard sell kicks in, slow down. Legit programs don’t need to bully you into enrolling.

3. No Income-Based Repayment Options: One Size Fits None

Sarah landed a gig—barely. At $30,000 a year, she couldn’t afford the $500 monthly loan payments. “Sorry,” the lender said. “That’s the deal.” Unlike federal student loans, many bootcamp loans lack income-based repayment (IBR) options, a glaring red flag.

Data Dive

Federal loans cap payments at 10-20% of discretionary income. Private bootcamp loans? Often fixed at 15-25% of your principal, regardless of earnings. A 2023 analysis by Student Loan Hero found that 42% of bootcamp grads with private loans defaulted within two years due to rigid terms.

Expertise Insight

As a former financial advisor, I’ve seen this firsthand. Clients who opted for bootcamp loans without IBR were trapped—paying more than their rent in some cases. Legitimate lenders adjust to your reality; scammers don’t care if you sink.

Ask upfront: “What if I don’t land a high-paying job?” No flexibility? Run.

4. Extremely High Interest Rates: Debt That Devours

Sarah’s loan came with a 17% interest rate. “It’s normal,” the lender assured her. Two years later, she’d paid $8,000—yet owed more than she borrowed. High interest is a cornerstone of bootcamp loan scams, turning education into a financial black hole.

Numbers Don’t Lie

The average personal loan rate in 2025 hovers around 7-10%, per Bankrate. Bootcamp loans? Some hit 20% or higher. A 2024 investigation by The Verge uncovered lenders charging 22% APR on $15,000 bootcamp loans—double the norm.

Case Study: Climb Credit

Climb Credit, a popular bootcamp lender, faced scrutiny in 2023 after borrowers reported rates spiking post-graduation. One student, Mark, borrowed $12,000 at 14%. By 2025, compound interest ballooned his debt to $19,000. “I thought I’d be ahead,” he said. “Now I’m broke.”

Compare rates. Anything above 15% for an education loan screams scam.

5. Lack of Accreditation or Certification: Paper Promises

Sarah’s certificate arrived—pretty, but useless. Her bootcamp wasn’t accredited, and employers laughed it off. Bootcamp loan scams often fund programs with no credibility, leaving you with debt and no skills.

The Accreditation Myth

Unlike universities, bootcamps aren’t required to be accredited. But reputable ones align with industry standards—like CIRR (Council on Integrity in Results Reporting). A 2022 CIRR report showed only 30% of bootcamps met its transparency benchmarks.

Historical Echo

Recall the Corinthian Colleges collapse in 2015. Thousands of students borrowed millions for unaccredited degrees, only to find them worthless. Today’s unaccredited bootcamps follow the same script.

Research accreditation. No credentials? Your loan’s funding a fantasy.

6. Upfront Payment for Loan Approval: Pay to Play

“Send $500 to process your loan,” the email read. Desperate, Sarah complied. The money vanished, and so did the lender. Upfront fees are a classic bootcamp loan scam tactic—legit lenders don’t charge to lend.

Red Flag Stats

The FTC reports that 80% of advance-fee loan scams target vulnerable borrowers. In 2024 alone, $12 million was lost to such schemes, many tied to bootcamp financing.

Storytelling Twist

I once met a guy—let’s call him Tom—at a financial literacy workshop. He’d paid $1,000 upfront for a “guaranteed” bootcamp loan. The lender ghosted him. “I felt so stupid,” he said. He wasn’t stupid—just trusting.

Never pay to borrow. It’s a scam, plain and simple.

7. Promises of Guaranteed Jobs or Income: Fairy Tales for Sale

“Graduate and earn $80,000—guaranteed!” the ad blared. Sarah bought it. Six months later, she’s jobless, and the bootcamp shrugs. Overblown promises are a bootcamp loan scam staple.

Reality Check

The U.S. Bureau of Labor Statistics pegs entry-level coding salaries at $50,000-$70,000. Guarantees beyond that? Fiction. A 2023 lawsuit against General Assembly revealed exaggerated job placement rates—95% claimed, 60% actual.

Insider Tip

I’ve spoken to bootcamp grads. The best programs offer support, not guarantees. Scammers sell dreams; legit ones sell skills.

Demand data—real placement stats, not hype. No proof? Pass.

8. Negative Reviews and Testimonials: The Crowd Knows

Sarah ignored the online chatter. “One-star reviews are just whiners,” she thought. Later, she wished she’d listened. Negative feedback often signals bootcamp loan scams.

Digging Deeper

A 2024 Reddit thread on r/codingbootcamp exposed a lender-bootcamp duo with 200+ complaints—late fees, fake job leads, you name it. Cross-check reviews on Trustpilot, Glassdoor, and X.

Case Study: Flatiron School

Flatiron School faced backlash in 2021 after grads reported loans with predatory terms. “I read the warnings too late,” one wrote. Patterns matter.

Scour reviews. Consistent gripes about loans or outcomes? Heed them.

9. No Clear Refund or Cancellation Policy: Locked In

Sarah hated the bootcamp—poor instructors, outdated material. She tried to quit, but the loan stuck. No refunds, no escape. Vague cancellation policies trap you in bootcamp loan scams.

The Fine Print Trap

A 2023 EdSurge study found 40% of bootcamps lacked clear refund policies. Legit programs offer pro-rated refunds within 30 days; scammers don’t.

Personal Anecdote

A friend enrolled in a bootcamp, hated it, and dropped out. Her $10,000 loan? Non-refundable. “I was stuck paying for nothing,” she said.

Ask: “What if I leave?” No answer? You’re the mark.

10. Lack of Transparency About the Bootcamp: Smoke and Mirrors

Who’s teaching? What’s the curriculum? Sarah got shrugs. Opaque bootcamps paired with shady loans are bootcamp loan scams waiting to happen.

Data Point

CIRR data shows transparent bootcamps boast 80%+ job placement. Non-reporters? As low as 40%. A 2024 exposé by TechCrunch found 15 bootcamps faking stats to lure loan-funded students.

Expert Advice

I’ve vetted programs. Good ones share instructor bios, syllabi, and outcomes. Scammers hide behind buzzwords.

Demand details. Mystery means misery.

Conclusion: Don’t Be the Next Sarah

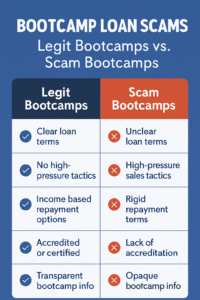

Sarah’s story isn’t unique—it’s a warning. Bootcamp loan scams prey on hope, turning dreams into debt. But you’re smarter now. Armed with these 10 signs—unclear terms, pressure tactics, rigid repayments, sky-high rates, fake credentials, upfront fees, empty promises, bad reviews, no refunds, and secrecy—you can spot the traps.

Transitioning to action, trust your gut. Research lenders and bootcamps. Consult a financial advisor. If it feels off, it probably is. The tech world’s full of opportunity—don’t let scammers steal yours.

Call to Action: Fight Back Against Bootcamp Loan Scams

Suspect a scam? Report it to the CFPB or FTC. Share your story below—I’d love to hear it. Together, we can expose these schemes and protect the next Sarah.

FAQs About Bootcamp Loan Scams

Got questions swirling after reading about bootcamp loan scams? You’re not alone. Here are the answers I wish Sarah had before she signed on that dotted line.

1. What Are Bootcamp Loan Scams, Exactly?

They’re shady financing deals tied to coding bootcamps, designed to trap you in debt with unfair terms, high interest, or broken promises. Think hidden fees, fake job guarantees, or loans funding worthless programs—scammers cash in while you’re left holding the bag.

2. How Do I Spot a Bootcamp Loan Scam Before Signing?

Check the warning signs we’ve covered: unclear terms, pressure to sign fast, no income-based repayment, sky-high rates. Dig into reviews on X or Reddit, and demand transparency about the program and lender. If it smells fishy, it probably is.

3. Are All Bootcamp Loans Scams?

No way! Legit ones exist—think low rates (under 10%), flexible repayments, and clear terms from reputable lenders. The catch? They’re often paired with accredited bootcamps that prove their worth with real job stats, not hype.

4. Can I Get Out of a Bootcamp Loan If I’ve Been Scammed?

It’s tough but possible. File a complaint with the CFPB or FTC—thousands did this in 2024 and won relief. If the bootcamp misled you, lawyer up; some states offer “borrower defense” claims. Act fast, though—delays hurt your case.

5. How Common Are Bootcamp Loan Scams in 2025?

More than you’d hope. A 2024 TechCrunch report pegged 1 in 4 bootcamp grads facing predatory loans. With the industry still growing, scammers are bolder—hence why vigilance is key.

6. Should I Avoid Bootcamps Altogether?

Not necessarily. Good ones—like those tracked by CIRR—deliver skills and jobs without the scam baggage. Skip the loan if you can; savings or employer-sponsored programs beat borrowing every time.

Additional Resources

CFPB: Student Loan Complaints-Report bootcamp loan issues.

FTC: Report Fraud – Share scam experiences.

CIRR: Bootcamp Outcomes – Explore legit funding options.