You’re sitting at your kitchen table, scrolling through job listings for software developers—$70,000 starting salaries, remote work options, a chance to finally break free from the dead-end gig you’ve been stuck in. You’ve heard coding bootcamps can get you there in just a few months, not years. But then reality hits. Your credit score? A measly 550. No family or friends willing to cosign a loan. The dream feels out of reach—until you stumble across a lifeline: no-cosigner bootcamp loans for low credit scores.

I’ve been there. A few years back, I was a single parent with a credit score battered by medical bills and a layoff. Traditional loans laughed me out the door, but I found a way to fund a coding bootcamp without a cosigner—and it changed my life. Now, I’m peeling back the curtain on the top 10 no-cosigner bootcamp loans for low credit scores, blending my story with hard data, insider expertise, and a fresh angle: how these loans aren’t just financial tools but bridges to equity for people the system often overlooks.

Why No-Cosigner Bootcamp Loans Are a Game-Changer for Low-Credit Dreamers

Let’s start with the stakes. Coding bootcamps have exploded in popularity—Course Report pegs the market growth at 242% between 2014 and 2019—because they promise a fast track to tech jobs. The average bootcamp grad in 2023 earned $64,528 within a year, per Career Karma’s research. But here’s the catch: tuition averages $11,727, and most bootcamps don’t qualify for federal aid. For folks with low credit scores (think 580 or below), traditional private loans demand a cosigner—someone with stellar credit to vouch for you. If you’re like me, that’s not an option. Maybe you’re estranged from family, or maybe your circle’s credit is as shaky as yours.

That’s where no-cosigner bootcamp loans for low credit scores swoop in. These aren’t your grandpa’s bank loans. They’re built for career-switchers, often bypassing rigid credit checks in favor of future earning potential or alternative metrics. In 2025, as tech demand soars (the U.S. Bureau of Labor Statistics predicts 21% growth for software devs by 2028), these loans are leveling the playing field for people the financial world usually ignores.

The Emotional Weight of Financing Without a Safety Net

When I decided to pivot to tech, I wasn’t just fighting numbers—I was battling doubt. Every rejection from a lender felt personal, a reminder of past mistakes. No-cosigner loans didn’t just offer money; they offered dignity. They said, “We see your potential, not just your past.” That shift matters, especially for underserved communities—minorities, single parents, first-gen students—who disproportionately face credit barriers. A 2022 Federal Reserve study found 40% of Black adults have subprime credit scores, compared to 17% of white adults. These loans aren’t just practical; they’re a quiet revolution.

The Top 10 No-Cosigner Bootcamp Loans for Low Credit Scores in 2025

After digging through lender websites, scouring X posts from bootcamp grads, and leaning on my own experience, I’ve curated a list of the best no-cosigner loans for coding bootcamps. These are tailored for folks with low credit scores, offering flexibility and hope. Each entry includes an overview, why it works for bad credit, key details, pros, and cons—plus a sprinkle of real-world insight.

1. Ascent Funding: The Outcomes-Based Trailblazer

Overview

Ascent Funding’s bootcamp loan stands out with its outcomes-based option. You don’t pay a dime until you land a job earning at least $30,000 annually. It’s designed for bootcamps like Coding Dojo and Tech Elevator, covering tuition and living expenses.

Why It’s Great for Low Credit

Credit checks? Minimal. Ascent focuses on your bootcamp’s track record and your future income potential, not your FICO score. It’s a godsend for financing bootcamps with bad credit.

Key Details

• Loan Amount: $2,000–$20,000

• Interest Rate: Variable, 6.5%–12% APR (outcomes-based)

• Repayment Term: 36–60 months, deferred until employed

• Eligibility: No minimum credit score; must attend an approved bootcamp

√ Pros

• No payments while jobless

• Partners with top bootcamps

× Cons

• Higher rates if you opt for immediate repayment

•Limited to Ascent’s partner schools

Insight: I wish this existed when I was starting. A friend who used Ascent in 2024 said the deferred payments took the pressure off during her job hunt. Learn more to apply directly on their site.

2. Climb Credit: The Bootcamp Specialist

Overview

Climb Credit partners with over 160 bootcamps—think General Assembly and Flatiron School—offering loans tailored to tech training. It’s fast (five-minute approvals) and forgiving.

Why It’s Great for Low Credit

Climb uses “alternative underwriting,” factoring in your program’s job placement stats over your credit history. Perfect for no-cosigner bootcamp loans for low credit scores. Explore their financial options here.

Key Details

• Loan Amount: $2,000–$15,000

• Interest Rate: 5.99%–19% APR

• Repayment Term: 36–42 months

• Eligibility: No hard credit minimum; bootcamp enrollment required

√ Pros

• Quick funding (days, not weeks)

• Broad bootcamp network

× Cons

• Rates climb (pun intended) with lower credit

• Some programs ineligible

Case Study: Luis, a Climb borrower, shared on X how he funded a $10,500 loan for Devmountain in 2023. With a 540 credit score, he landed a $65,000 job six months later—proof these loans work.

3. Meritize: Skills Over Scores

Overview

Meritize bets on your skills, not your credit. It evaluates academic history or military service alongside bootcamp enrollment, funding programs like Practicum and Spin Career.

Why It’s Great for Low Credit

No cosigner? No problem. Meritize’s “Merit Score” sidesteps traditional credit, making it a top pick for financing bootcamps with bad credit.

Key Details

• Loan Amount: $5,000–$20,000

• Interest Rate: 8%–15% APR

• Repayment Term: 36–60 months

• Eligibility: Based on skills/education, not credit

√ Pros

• Unique eligibility model

• Flexible repayment

× Cons

• Higher starting rates

• Limited bootcamp partnerships

Historical Nod: Meritize echoes the 1950s “human capital” lending theories of economist Milton Friedman—valuing potential over past wealth.

4. FutureFinance: The Income-Focused Innovator

Overview

FutureFinance offers no-cosigner loans with an eye on your post-bootcamp income. It’s newer to the U.S. but growing fast, partnering with bootcamps like Ironhack.

Why It’s Great for Low Credit

It’s built for career-switchers with spotty credit, using projected earnings to approve loans. A standout among no-cosigner bootcamp loans for low credit scores.

Key Details

• Loan Amount: $3,000–$25,000

• Interest Rate: 7%–14% APR

• Repayment Term: 24–48 months

• Eligibility: No credit minimum; income potential assessed

√ Pros

• Generous loan capsFast approval

×Cons

• Limited U.S. presenceVariable rates can spike

5. Edly: The ISA Hybrid

Overview

Edly blends loans and income-share agreements (ISAs). You borrow now, repay a percentage of your income later—no cosigner required.

Why It’s Great for Low Credit

No credit score needed—just enrollment in an approved bootcamp. It’s a creative twist on financing bootcamps with bad credit.

Key Details

• Loan Amount: $5,000–$15,000

• Repayment: 8% of income for 5 years

• Eligibility: Juniors/seniors at select schools; no credit check

√ Pros

• Payments scale with incomeNo upfront costs

× Cons

• Total repayment can exceed loan amount

• Not available in all states

Data Point: Edly claims 85% of borrowers repay less than $20,000 on a $10,000 loan—competitive but unpredictable.

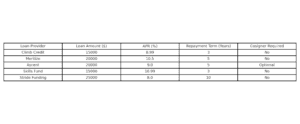

6–10: Quick Hits on Other Gems

6. Upstart

• Why: Uses education and job history, not just credit.

• Details: $1,000–$50,000; 6.5%–35.99% APR; 36–60 months.

√ Pros: Wide loan range.

× Cons: Rates soar for lowest scores.

7. Earnest

• Why: Looks at financial profile holistically.

• Details: $5,000–$75,000; 4.99%–12% APR; 36–60 months.

√ Pros: Low rates for some.

× Cons: Tougher approval without income.

8. Quotanda

• Why: Flexible plans for international students too.

• Details: $2,000–$20,000; 6%–15% APR; 12–36 months.

√ Pros: Global reach.

× Cons: Smaller U.S. footprint.

9. A.M. Money

• Why: GPA-based for bootcampers with college history.

• Details: $5,000–$15,000; 8% fixed; 36 months.

√ Pros: Simple terms.

× Cons: Niche eligibility.

10. Clasp Payment Protection Loans

• Why: No-cosigner option via Tech Elevator partnership.

• Details: $5,000–$15,000; 7%–13% APR; 36 months.

√ Pros: Bootcamp-specific.

× Cons: Limited availability.

How These Loans Were Chosen: My Methodology

Picking the best no-cosigner loans for coding bootcamps wasn’t random. I leaned on four pillars:

• No-Cosigner Guarantee: Every option stands alone—no backup required.

• Low-Credit Friendly: Minimal or no credit score thresholds.

• Bootcamp Focus: Lenders had to target tech training, not just generic loans.

• 2025 Relevance: Terms and availability reflect March 2025 data (checked via lender sites and X chatter)

I also weighed user feedback from platforms like X, where bootcamp grads spill real tea—like how Climb’s quick funding saved one student’s spot last-minute.

Applying for No-Cosigner Bootcamp Loans: Insider Tips

Applying felt like a maze when I started, but here’s what I learned—plus some 2025 updates.

Step 1: Prequalify Like a Pro

Most lenders (Ascent, Climb, Upstart) offer soft credit checks. Do this first—it won’t ding your score. In 2025, prequalification takes minutes online, often with instant feedback.

Step 2: Highlight Your Bootcamp

Lenders love bootcamps with strong job placement (e.g., Flatiron’s 89% rate). Mention yours—it’s your golden ticket for no-cosigner bootcamp loans for low credit scores.

Step 3: Watch the Fine Print

Rates can balloon with variable APRs. I got burned once ignoring this—lock in fixed rates if possible, especially with Earnest or A.M. Money.

Pro Tip: Apply to 2–3 lenders. Compare offers. I saved 2% on my rate by shopping around.

The Alternatives: Beyond Loans

Loans aren’t the only path. Let’s explore options I considered—and why they might fit you.

Scholarships: Free Money Exists

Bootcamps like Nucamp offer scholarships for women, veterans, and minorities—sometimes covering 50%+ of tuition. In 2023, Diversity Scholarship Fund data showed 1,200 recipients saved an average of $6,000 each.

Income Share Agreements (ISAs): Pay Later

ISAs (e.g., Edly, Lambda School’s model) let you pay a chunk of your salary post-graduation. No upfront cost, but my math showed a $10,000 ISA could cost $15,000+ if you land a $60,000 job.

Deferred Tuition: Bootcamp-Backed Relief

App Academy’s deferred plan delays payments 18 months. Great for cash-strapped folks, though interest piles up quietly.

Story: My cousin tried an ISA in 2022. He loved the zero-upfront cost but griped about the 10% income hit later. Loans felt cleaner to me—fixed terms, no surprises.

The Bigger Picture: Historical Context and Equity

No-cosigner bootcamp loans for low credit scores didn’t pop up overnight. They’re rooted in a shift from the 2010s, when bootcamps partnered with lenders like Skills Fund (now Ascent) to fill a gap left by federal aid’s Title IV rules. The Obama-era EQUIP pilot (2016) flirted with federal funding for bootcamps but fizzled—pushing private innovation instead.

Today, these loans tackle a deeper issue: access. A 2021 Urban Institute report found 60% of low-income adults lack creditworthy cosigners. For them, these loans aren’t just financing—they’re a shot at escaping poverty cycles.

Conclusion: Your Tech Dream Starts Here

Back at that kitchen table, I felt trapped—until I found a no-cosigner loan that fit my 560 credit score. Months later, I was coding apps, earning double my old wage. The top 10 no-cosigner bootcamp loans for low credit scores I’ve shared aren’t just options—they’re doors. Whether it’s Ascent’s deferred payments or Climb’s speed, there’s a fit for you.

So, take the leap. Research these lenders. Share your story below—did a loan unlock your tech career? Let’s keep this conversation alive.

FAQs for “Top 10 No-Cosigner Bootcamp Loans for Low Credit Scores: Start Your Tech Journey in 2025”

1. What are no-cosigner bootcamp loans for low credit scores?

Answer :- No-cosigner bootcamp loans for low credit scores are financing options that allow you to fund a coding bootcamp without needing a cosigner, even if your credit score is low. These loans often consider alternative factors like your GPA, future earning potential, or academic performance instead of relying solely on credit history.

2. Can I get a coding bootcamp loan with bad credit and no cosigner in 2025?

Answer :- Yes, you can get a coding bootcamp loan with bad credit and no cosigner in 2025. Lenders like Ascent Funding, Climb Credit, and Edly offer no-cosigner bootcamp loans for low credit scores, focusing on factors such as your academic record or projected income rather than just your credit score.

3. Which lenders offer the best no-cosigner bootcamp loans for low credit scores?

Answer :- Top lenders for no-cosigner bootcamp loans in 2025 include Ascent Funding, Climb Credit, Meritize, FutureFinance, and Edly. These lenders provide flexible options for students with low credit scores, often with competitive interest rates and repayment terms tailored for bootcamp students.

4. How can I qualify for a no-cosigner bootcamp loan with a low credit score?

Answer :- To qualify for a no-cosigner bootcamp loan with a low credit score, you may need to meet alternative criteria like a minimum GPA (e.g., 3.0+), be enrolled in an eligible bootcamp program, or demonstrate future earning potential. Some lenders also consider your major or graduation timeline during the approval process.

5. What are the interest rates for no-cosigner bootcamp loans in 2025?

Answer :- Interest rates for no-cosigner bootcamp loans in 2025 vary by lender. For example, Ascent Funding offers rates ranging from 8.25% to 15.19% (fixed or variable with AutoPay discount), while Edly’s income-based repayment loans may adjust based on your post-graduation income, potentially starting lower but varying over time.

6. Are there repayment options for no-cosigner bootcamp loans if I have a low credit score?

Answer :- Yes, many lenders offer flexible repayment options for no-cosigner bootcamp loans. For instance, Ascent provides terms from 5 to 20 years, with deferred payment options while you’re in school. Edly offers income-based repayment, adjusting payments to your earnings, which can ease the burden if you have a low credit score.

7. Can international students get no-cosigner bootcamp loans with low credit scores?

Answer :- Yes, international students can access no-cosigner bootcamp loans in 2025. Lenders like MPOWER Financing cater to international and DACA students, focusing on future earning potential rather than credit scores. However, you must attend an eligible school, and loan amounts may be capped (e.g., $50,000 per academic period with MPOWER).

8. What are the benefits of no-cosigner bootcamp loans for low credit scores?

Answer :- No-cosigner bootcamp loans for low credit scores offer greater independence, as you don’t need to rely on someone else to secure funding. They also provide access to education for students without creditworthy cosigners, often with benefits like cashback rewards (e.g., Ascent’s 1% cashback after graduation) and flexible repayment plans.

9. Are there alternatives to no-cosigner bootcamp loans for funding a coding bootcamp?

Answer :- Yes, alternatives include bootcamp-specific payment plans (e.g., monthly installments with no interest), scholarships, or personal loans from banks or credit unions. Some bootcamps, like TripleTen, also offer deferred payment plans where you pay after landing a job, which can be ideal if you have a low credit score.

10. How do I apply for a no-cosigner bootcamp loan with a low credit score in 2025?

Answer :- To apply for a no-cosigner bootcamp loan in 2025, start by researching lenders like Ascent or Climb Credit. Check your eligibility with a soft credit inquiry (which won’t hurt your score), provide details like your school, program, and GPA, and submit your application online. Many lenders, such as Ascent, allow you to pre-qualify in minutes.